Are you getting ready to pay your first employee? Not...

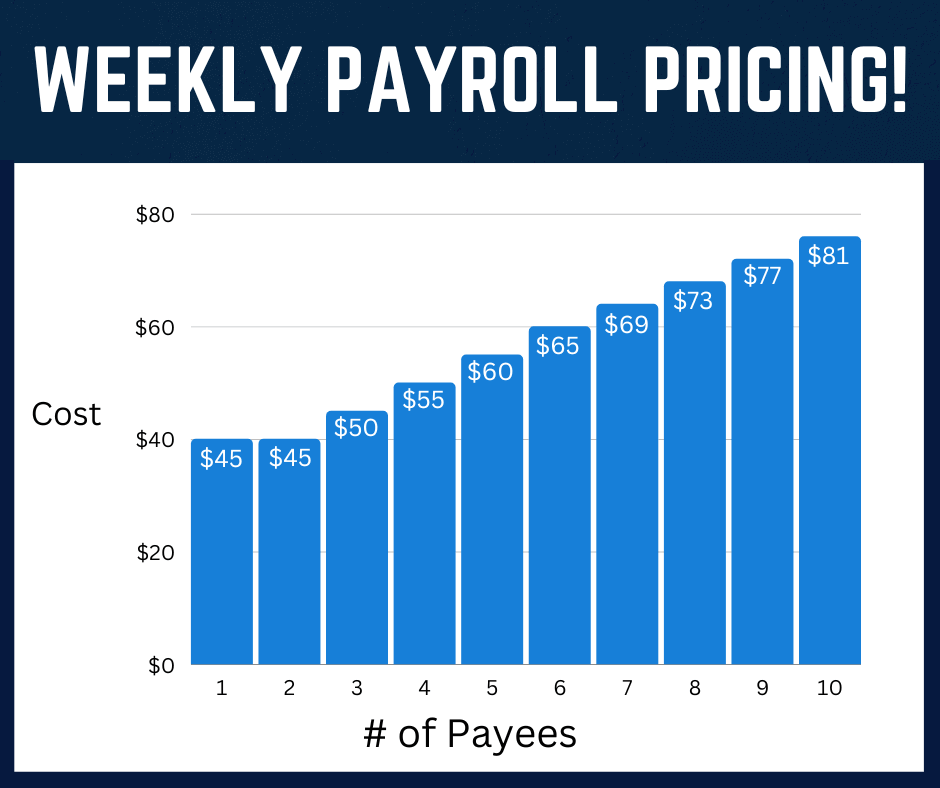

Read MoreWe make our pricing simple

Side note: If W2s & or 1099s are not included as part of your payroll package be sure to check the W-2/1099 count in the quote. We’ve seen a company with 40 employees get quoted a rate for 40 W-2’s. You and I know that zero turnover in a year is not realistic, and so did the payroll service. Not to mention trucking has a much higher turnover rate. This is often done to give you the appearance of a lower fee. Fees may look higher or lower than other quotes at first glance but little things like that can make a big difference.

No surprises in our pricing

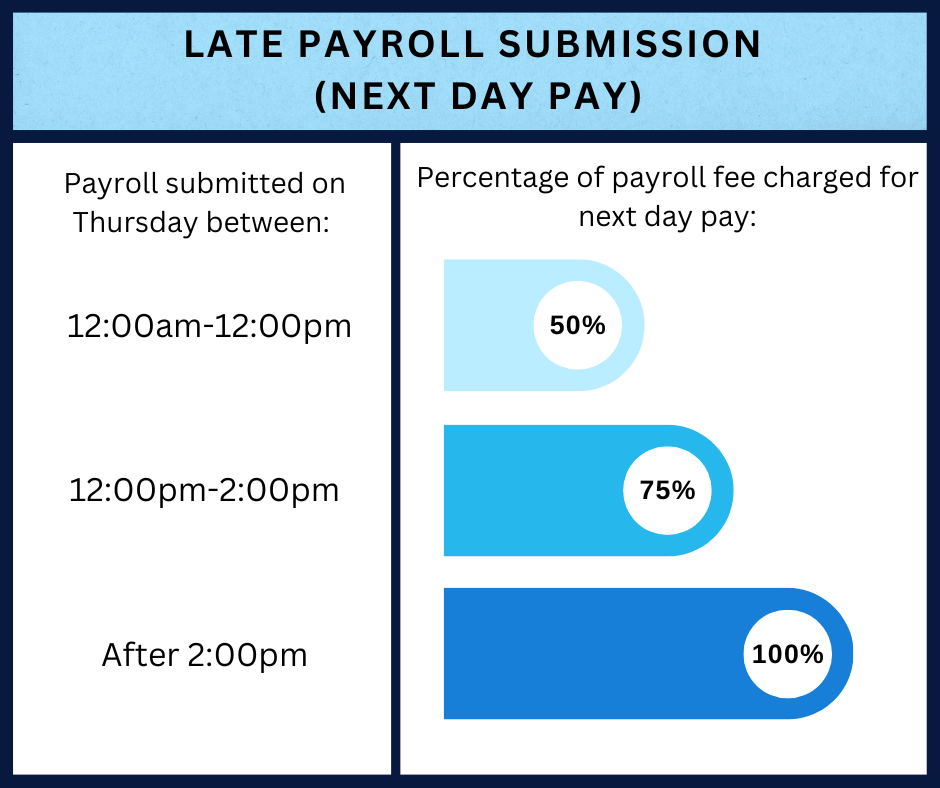

Additional Fees:

Payroll Set-Up fee:

One-time fee starting at $300

We hope that by pricing this way it is easy for you to make the best decision for your company.

With over 20 years of experience in entrepreneurship, management, business planning, financial analysis, software engineering, operations, and decision analysis, Mike has the breadth and depth of experience needed to quickly understand entrepreneurs’ businesses and craft the most suitable solutions.

Contact Us!

Incomplete Truck Driver Paperwork: How It Can Cost You Big

Have you ever felt pressured to get a new driver...

Read MoreHow Long Does It Take to Set Up Trucking Payroll Service?

Worried switching payroll companies means missing paydays or a stressful...

Read MoreCheap Trucking Payroll Services: Why They Often Cost More

Are you saving money — or setting yourself up for...

Read MoreI Want to Do Trucking Payroll Legal – But I Don’t Want to Go Broke

If you’re worried that switching from 1099 to W-2 will...

Read More