Have you noticed your paycheck has no federal income tax withheld — and wondered if something went wrong?

Or maybe someone told you to “just claim exempt,” but you’re not sure if that’s legal — or smart?

Every year, thousands of employees make mistakes with their W-4 that lead to surprise tax bills, IRS penalties, or missed refunds — all because they didn’t fully understand what “exempt” really means.

In this article, we’ll explain exactly who qualifies to claim exemption from federal tax withholding, what happens if you do it incorrectly, and how to fill out the W-4 the right way — so you can avoid expensive surprises later.

What Is Federal Tax Withholding and How Does It Work?

When you work for a company, your employer takes out some money from each paycheck. That money goes to the government to pay your federal income taxes. This is called federal tax withholding.

Instead of paying one big tax bill at the end of the year, small amounts are taken out of your checks all year long. It’s like paying your taxes little by little.

What “Exempt from Federal Tax Withholding” Really Means

If you’re exempt, it means no federal income tax gets taken out of your paycheck.

But here’s the part many employees miss: Being exempt only applies to federal income withholding — the kind reported on Form 941.

You will still see other taxes come out of your check:

- Social Security Tax

- Medicare Tax

These are called FICA taxes, and your employer cannot remove those, even if you’re exempt from federal income tax withholding. FICA taxes are required by law and help pay for benefits you’ll use later in life.

Important: Even if you’re exempt from federal tax, you’ll still pay Social Security and Medicare taxes.

Top Reasons Federal Income Tax Isn’t Withheld from Your Paycheck

If you notice no federal tax was taken out, here are a few reasons why:

- You marked “Exempt” on your W-4 form.

- You didn’t earn enough money to trigger withholding.

- There was a mistake on your paperwork or payroll.

If you didn’t mean to claim exempt, or if you weren’t supposed to, this could cause a big tax bill later. That’s why it’s important to know the rules before you claim exemption.

Who Qualifies to Claim Exempt from Federal Income Tax Withholding?

Not everyone can claim exemption. The IRS has two rules you must follow.

You owed $0 in federal taxes last year

If you filed a return and didn’t owe anything — or got everything back — you passed the first test.

You expect to owe $0 in federal taxes this year

This means your income is low enough, or you qualify for certain tax credits, so you won’t owe anything for this year either.

You must meet both rules to claim exempt. If you’re not sure, it’s better to have some tax withheld just in case.

What to Expect If You Incorrectly Claim Tax Exemption

If you claim exemption but don’t actually qualify, no federal taxes will be taken out — but you’ll still owe money at tax time. That can lead to:

- A large tax bill you weren’t expecting.

- Penalties and interest from the IRS for not paying enough throughout the year.

The IRS might also flag your return or ask questions. It’s not illegal if it’s a mistake, but it can still cause problems.

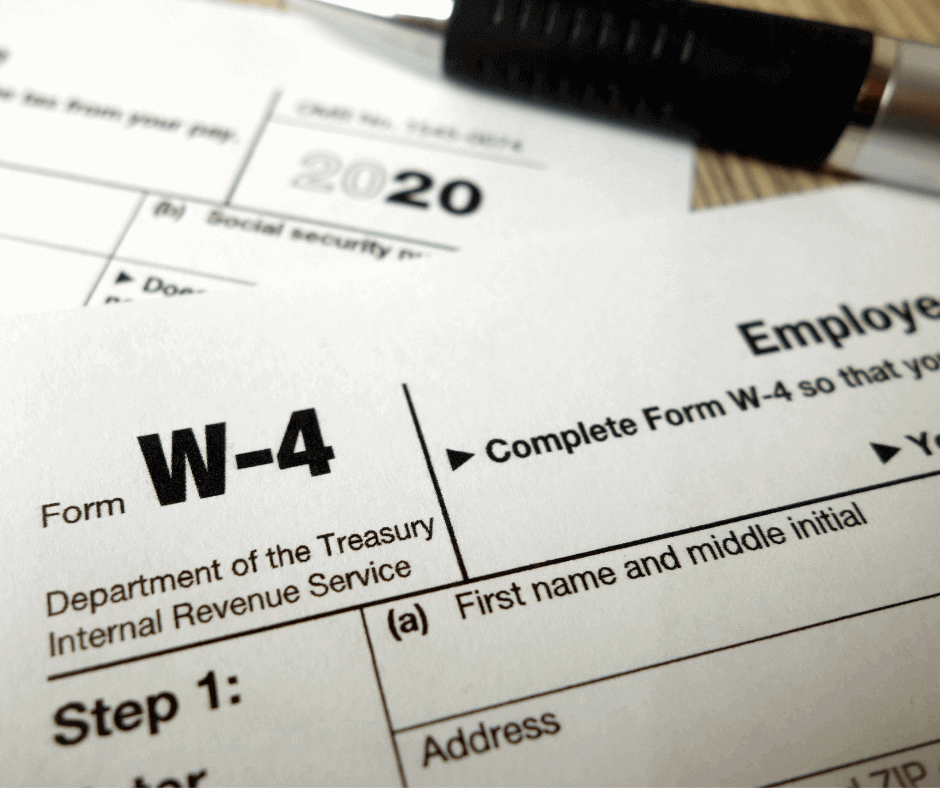

Step-by-Step Guide to Claiming “Exempt” on IRS Form W-4

Since 2020, the IRS has used a new version of the W-4 form. It no longer uses “allowances.”

Here’s how to fill it out if you qualify for exempt:

- Fill out Steps 1 and 5 only.

- Step 1: Enter your name, address, Social Security number, and filing status.

- Step 2: Sign and date the form.

- Leave Steps 2, 3, and 4 blank — except for one thing…

- In Step 4(c), write “Exempt” in the box that says “Extra withholding.”

- Give the form to your employer — not the IRS.

- Do this every year. If you want to stay exempt, you must give your employer a new W-4 each calendar year.

Tip: If your income or situation changes, update your W-4 right away.

When You Should Avoid Claiming Exempt from Federal Taxes

Don’t file exempt if:

- You owed taxes last year.

- You expect to owe taxes this year.

- You’re not sure — it’s better to have something withheld than to get hit with a big bill later.

Why Understanding Tax Exemption Is Critical for Employees

Your paycheck might look bigger with no taxes taken out — but if you don’t qualify for exempt status, it can backfire fast.

At the end of the year, the IRS will expect their money. If you didn’t pay it during the year, you’ll owe it all at once — plus possible penalties.

Getting this right means less stress, fewer surprises, and more control over your money.

Key Takeaways About Claiming Tax Exempt Status

- If you qualify, claiming exemption can give you more take-home pay.

- But if you’re not careful, it could cost you a lot at tax time.

- Only claim exempt if you meet both IRS rules.

- FICA taxes (Social Security and Medicare) will still come out of your check no matter what.

- The new W-4 form is easy to fill out — but make sure you follow the right steps.

Next Steps: How to Get Help Before Claiming Exempt

If you’re not 100% sure whether you qualify to claim exemption, the best thing you can do is talk to a tax professional or your tax preparer.

They can look at your full tax situation — including your income, credits, and past returns — and help you figure out if claiming exemption is the right move for you.

Bottom line: Don’t guess when it comes to your taxes. Get advice from someone who knows the rules and can help you avoid costly mistakes.

Before founding Superior Trucking Payroll Service, Mike was the CFO of a trucking company with 80 trucks and a thriving brokerage. This experience gave him the perspective that a payroll solution has to make the lives of the office people better. All the solutions he has designed are to benefit everyone. Our company mission is to help trucking families and that includes the company owners, the drivers, and the office.