Why are truck driver pay stubs still so confusing? If...

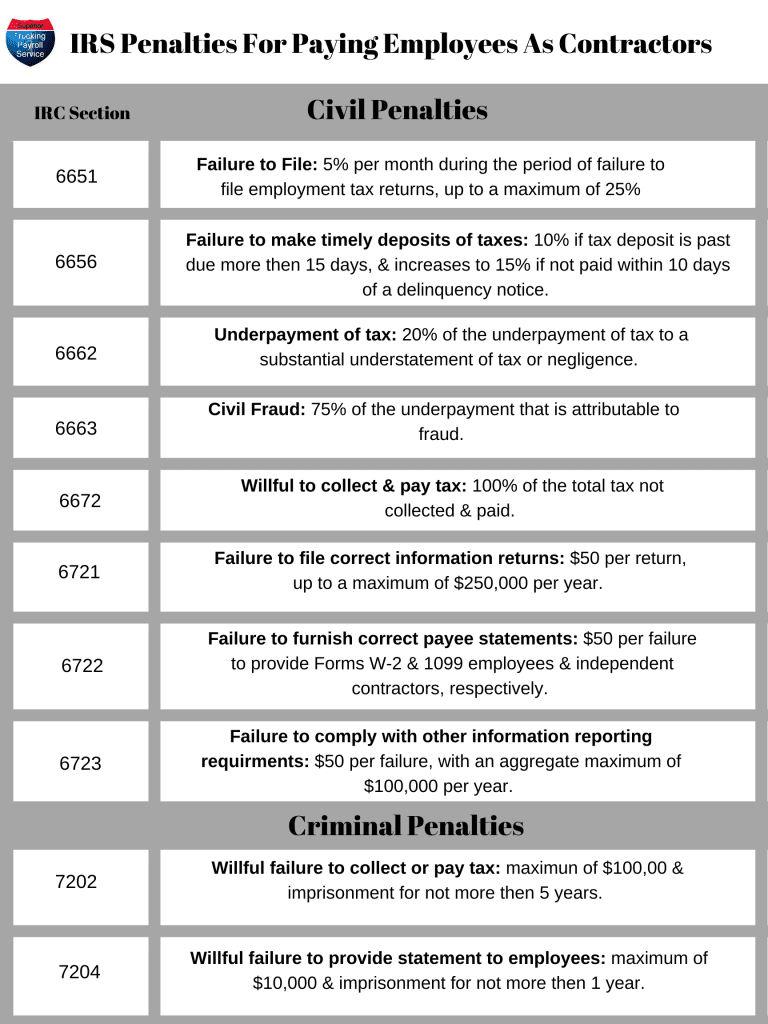

Read MoreWe’ve talked in other articles about the importance of paying W-2 when the situation requires it. The costs of non-compliance are large enough to bankrupt your trucking company. But the costs are zero if you don’t get caught, right? This article will talk about the three most likely ways your trucking company will get caught for employee misclassification.

The first is unemployment.

If you have a 1099 truck driver that you terminate, they may decide to file for unemployment benefits depending on the situation. They may even file knowing they asked to be paid by 1099, and even if they signed a contract saying that they are 1099.

Next, the state will send your trucking company claim forms. Your response will be that the driver was a 1099 and not an employee. You might even include the contract that the driver signed as evidence of your position. Great! Problem solved right? Nope!

The problem is the driver can reply with a poor me story. Claiming how they didn’t know what they were signing and how you don’t have the ability to waive their rights. You’ll notice the theme of truck drivers getting really smart once they leave you throughout this article.

Once the driver makes the claim to be an employee and not a contractor, the state will investigate. By investigate, I mean they will go poking around your trucking company. They will make a determination of whether or not the truck driver was truly an employee or a contractor. The determining factors are detailed in this article. But even if you prevailed (you won’t), do you really want the state all up in your trucking company business?

The second way is workers' compensation claims.

The healthcare providers are motivated to make it a workers comp claim. But what if you have Occupational Accident Insurance (Occ Acc)? Occ Acc can be a great substitute for workers comp with owner-operators, but it has limits and is not consistent from one policy to the next. Workers’ compensation is usually defined by the state and has no claim amount limit. Occ Acc will have a limit. Once the Occ Acc limit is reached, expect that the providers will come after your trucking company if they have not already. Further, once the limit is reached, there are no more lost wage benefits to be paid. The driver’s family may get a legal expert involved and unravel the whole thing. All this assumes that the Occ Acc policy stands up and pays the claim in the first place. What if the Occ Acc policy determines that the driver was an employee and says it should be work comp? What if the Occ Acc policy has some rider that disqualifies certain events or only pays in certain events?

In this scenario, the driver is in an accident and gets an ambulance ride to the hospital. When they get to the hospital, they will be asked if it was a work-related injury. Since the EMTs pulled the driver out of the truck with your trucking company’s name on it, it will be evident that it was work-related. The hospital and the ambulance company would both rather bill workers’ compensation insurance. Because if they billed the health insurance or Medicaid, they will be paid less. Regular health insurance, Medicaid, or any other type of personal health insurance have rates that can be negotiated for everything. Not so with workers’ compensation insurance companies. The provider can bill their full rates. Like the ones you might see on an explanation of benefits form before the health insurance pays it. We are talking big money.

I was talking to a prospective client once about this whole W-2 vs 1099 issue a while back, and I asked him what if there was an accident? He said that the local community of people from his country of birth would take care of his family. I remember thinking, that’s great that others will step up and help, but who is paying the hospital? The hospital is not in the community that way.

The third most likely way that trouble will find your trucking company in the 1099 vs W-2 issue is the truck driver’s income taxes.

Let’s say the driver asks you to 1099 them. Let’s also say that you told them they’d owe taxes at the end of the year because you would not be withholding anything from their checks (Don’t give tax advice unless you are qualified, refer them to someone). They agree that they are responsible for taxes and work for you as a 1099. We get to the end of the year and they have a $65,000 1099 form. They do their taxes and they owe $14,000. The driver can’t believe it! They never thought it would be that much! Now they want you to pay it as if you did not pay it to them all year. You remind them that they agreed to be in charge of their own taxes and even show them written confirmation. The driver comes back to you saying they don’t have the money because they spent it all. They tell you to either you pay it or they will go to the IRS and say they were supposed to be a W-2 employee. If they go to the IRS, you’ll have the same trouble as in the first scenario. Notice again how the driver got smart when it helped them.

So now you have a decision to make about the $14,000. But wait, it gets better! Ok, maybe not better. Even if you paid the $14,000 to the driver, they still could turn you in for employee misclassification and keep the $14,000. It’s a bad deal for you all the way around.

These are three ways that you could get found to be paying improperly but there are more. A work comp audit, a former driver that wants to stick it to you, and just luck of the draw are just three more. I urge you to think twice before paying a truck driver 1099 when they are supposed to be paid by W-2.

Written by Mike Ritzema

With over 20 years of experience in entrepreneurship, management, business planning, financial analysis, software engineering, operations, and decision analysis, Mike has the breadth and depth of experience needed to quickly understand entrepreneurs’ businesses and craft the most suitable solutions.

Contact Us!

Trucking Payroll Warning: Are You Paying Per Diem the Right Way?

Are you 100% sure you’re handling per diem correctly in...

Read MoreStart-Up Trucking Company Payroll Help – No, You Are Not Too Small

Just Bought Your Second Truck? Now What? “How do I...

Read MoreWhat’s the Difference Between a Garnishment and a Friend of the Court (FOC) Order?

Have you ever looked at your paycheck and wondered, “Why...

Read MoreTrucking Payroll Tip: How To Handle Missing or Incorrect SSNs

What do you do if a truck driver gives you...

Read More