Let's Talk Pricing for Trucking Payroll

At Superior Trucking Payroll Service, we know you want answers before making big decisions. That’s why we offer tools like our payroll cost estimators. Our goal is to give you peace of mind and help you move forward with confidence.

Our Instant Price Tool

We’ve made it simple for you to get an instant price estimate.

We will NOT sell your information

Would you like to schedule a phone call with us? Click below and pick your own time to chat with us.

Want to Save Even More Money?

What Goes into the Cost of Trucking Payroll Service?

We understand that payroll service pricing can be complicated. The cost often depends on factors like the size of your team, how often you run payroll, and the specific needs of your trucking company.

The one-time setup fee makes sure your payroll system is built for success from day one. It covers tasks like entering and verifying employee records, setting up your pay schedules, and ensuring accurate payroll tax filings. Additionally, we provide training and support during this setup phase so you’re fully equipped to manage payroll efficiently moving forward. This fee helps us lay a strong foundation, saving you time and stress down the road.

At Superior Trucking Payroll Service, we know you want answers before making big decisions. That’s why we offer tools like our Instant Price Estimator. Our goal is to give you peace of mind and help you move forward with confidence.

Additional Fees You Should Know About

We keep pricing simple, but a few extra fees may apply in certain situations:

- One-time Setup Fee – Required for all new accounts. Amount varies on first payroll date and company size.

- Add a State Later – $50 per state

- Remove a State Later – $100 per state

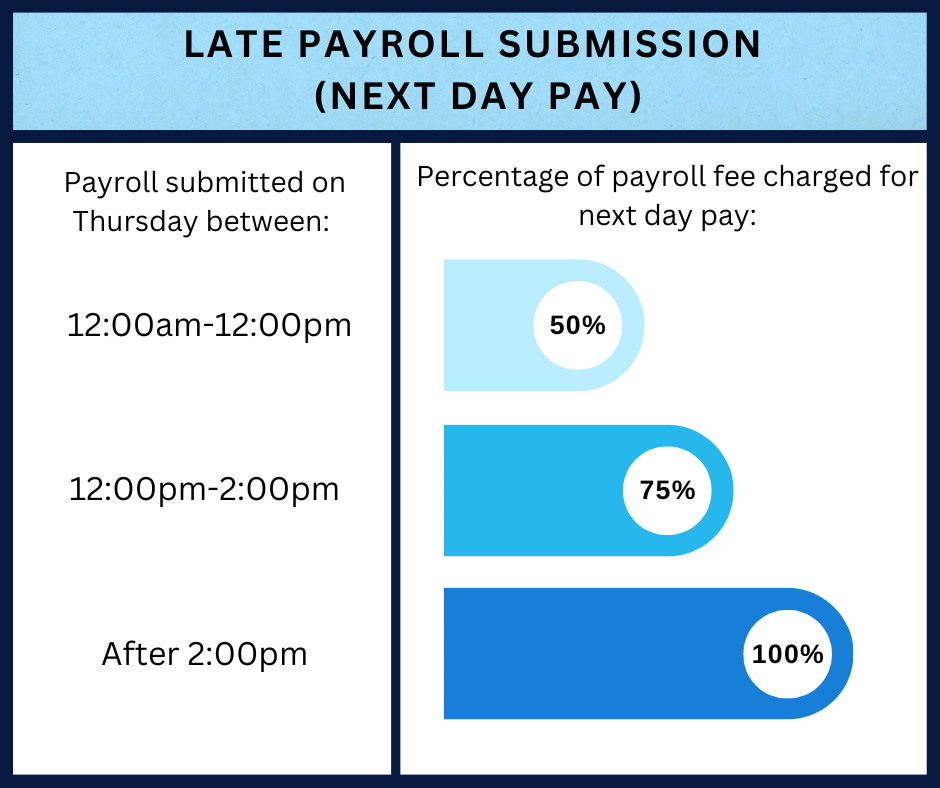

- Late Payroll Submission (Next Day Pay) - see graphic

- Supplemental Payroll - extra payroll run outside your regular schedule

More Than Numbers—A Partner Who Cares

We’re not just about payroll services; we’re about relationships. Unlike big-box providers, we understand the unique challenges trucking companies face. We’re here to guide you, answer your questions, and provide solutions tailored to your needs. You’ll never be just a number to us.

That’s why so many trucking companies trust us with their payroll needs. From owner-operators to larger fleets, our clients know they’re getting personalized service they can count on. We’re proud to work with some incredible companies, and we’d love for you to see the difference a true partnership can make.

Trucking Payroll FAQs

Not only do we form relationships with our customers but we make sure that we fit our payroll service to their specific needs. We can customize what’s on your paystub such as; load number, delivery date, the city the driver started in or ended in, or both, or miles driven.

A $15 weekly “missed payroll fee” is charged to keep your tax filings up to date. Unlike other payroll services, there are no extra charges for quarter-end fees or tax filing fees.

We believe that people like simplicity, especially when it comes to pricing. Our base fee starts at $45 a week for up to two payees. It doesn’t matter if they are 1099, W2, or a combination. Additional payees are an extra $5 per week. Larger companies with more people on payroll will pay less for additional payees.

You can cancel our services at any time. But we will need a phone call or email from the owner, or our main contact with your company stating the date of your last payroll with us. We do not have a cancellation fee.