Have you ever been surprised by a payroll service fee—even on a week you didn’t run payroll?

Or found yourself scrambling at the last minute to get your payroll data submitted, unsure if your drivers would still get paid on time?

If you’ve experienced either situation, you’re not alone—and we’re here to help you avoid it in the future.

At Superior Trucking Payroll Service, we’ve developed a submission schedule that keeps things simple, reliable, and transparent. Whether you’re already a client or exploring how our payroll service works, understanding this schedule is key to staying compliant, avoiding unnecessary fees, and ensuring your drivers are always paid on time.

Let’s walk through it all together so you can stay ahead of the curve and in full control of your payroll.

In this guide, you’ll learn:

- When we need your payroll data (and why).

- How holiday weeks change the submission timeline.

- What happens if payroll is submitted late.

- What “Next Day Pay” fees are—and how to avoid them.

Our Standard Payroll Submission Schedule

To make sure your drivers get paid correctly and on time, we ask that you send us your payroll data two days before payday.

But here’s the inside tip: the earlier you send it, the better.

Example: Friday Paydays

- Submit payroll data on Wednesday before midnight Eastern Time

- Preferred submission time: Earlier in the day Wednesday

Example: Wednesday Paydays

- It gives us more time to process everything carefully

- We can send you a payroll preview for approval (what we call “blessing it”)

- You’ll have time to double-check and request any changes or additions

- It helps avoid last-minute stress or potential fees

Getting payroll in early helps everyone stay calm, accurate, and on schedule—especially when things change last minute, like with driver bonuses or adjustments.

Holiday Weeks: Adjusted Schedule and Extra Grace

Holidays can make things tricky. If a Federal Holiday lands on a business day, the Federal Reserve closes—and that means no banking and no direct deposits that day.

If Friday Is a Holiday:

- Payroll gets processed early for Thursday deposits

- Please send in your payroll data by Tuesday

- Grace period: You can still submit by Wednesday before 10:00 AM Eastern Time

After that, Next Day Pay fees may apply.

This grace period is our way of giving you some breathing room—while still keeping your drivers paid before the long weekend.

Late Payroll Submission: Next-Day Pay Fees

Sometimes, things come in late—we get it. But when that happens, it creates an expedited situation on our end.

To process payroll late and still get drivers paid, we have to:

- Rush your file through manually

- Re-prioritize staff tasks

- Do extra behind-the-scenes work

Why Fees Are Charged

Think of it like trucking freight. If a broker calls and says, “This load is HOT,” the rate goes up.

Same here—faster service requires more resources, so there’s a cost. You will see this charge on your Cash Summary (first page of reports) labeled as NDP; this stands for Next Day Pay.

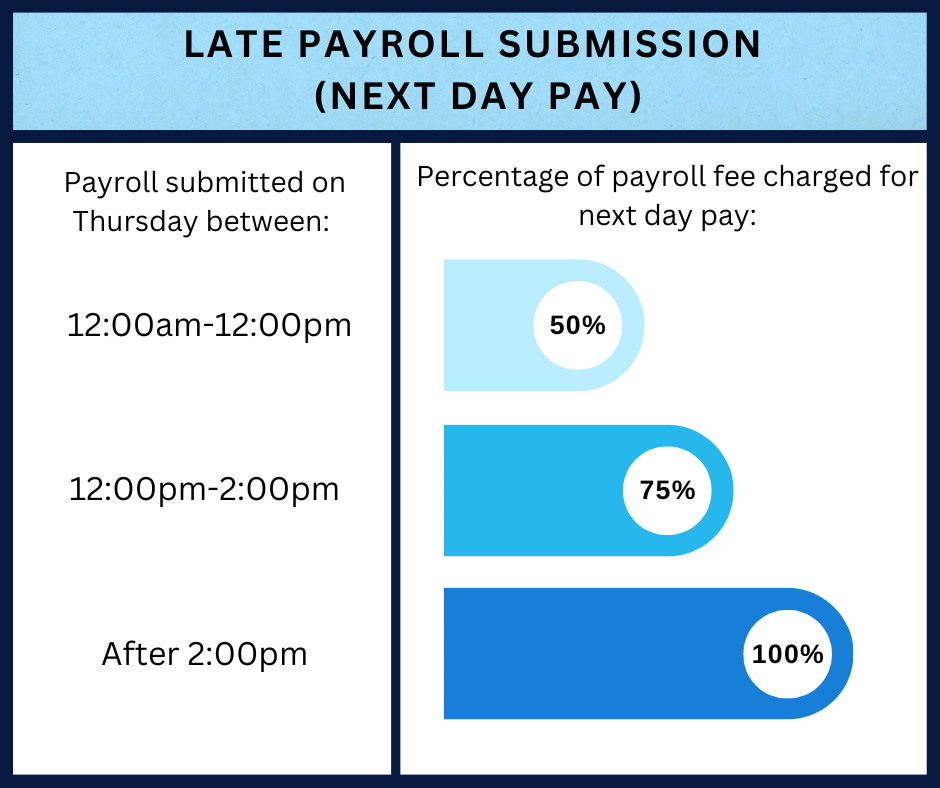

Next Day Pay Fee Schedule

Here’s how the fees break down(see graph to the right), based on how late the data is received (all times are Eastern and based on when we receive the info in our Michigan office):

We don’t want to charge extra—but when we have to rush, these fees help cover the added workload.

Missed Payroll Week: Why There’s Still a Fee

If you skip a payroll week (no drivers to pay, etc.), we still need to handle:

- Required filings with the IRS and state

- Keeping your account in good standing

That’s why we charge a $15 missed payroll fee. It covers the behind-the-scenes work that keeps your payroll tax accounts accurate and in good standing.

Bonus for Clients: Unlike most payroll providers, we don’t charge extra for quarterly or year-end tax filings—that’s already included in your regular service.

How to Avoid Fees and Stay on Track

Here are a few simple ways to keep your payroll smooth with no extra fees:

-

Use a Payroll Checklist

Create a checklist that covers every item we need—so you don’t miss anything.

-

Submit Early When You Can

If your payroll is finalized and ready to go on Tuesday for a Friday deposit, don’t hold it until Wednesday. Sending it in early gives us more time to process, review, and send a preview for your approval.

-

Mark Submission Days on Your Calendar

Wednesday midnight (ET) for Friday paydays. Monday for Wednesday paydays.

-

Have a Go-To Payroll Contact

Assign someone on your team to handle submissions weekly.

-

Let Us Know About Changes Early

If you’ve got new hires, send them to us right away, not wait until you send payroll. This way, we can have your new hires entered into the system and ready for payroll.

Simple Process, Reliable Payroll

Now that you’ve seen how our payroll submission schedule works, you know exactly when to send in your data, how holidays affect the process, and what fees may apply if timelines aren’t followed.

We built this schedule not to be rigid—but to make payroll smoother, more accurate, and more predictable for you and your drivers. Submitting early gives us the time we need to verify everything, send you a preview for approval, and avoid last-minute stress or unexpected costs.

Your next step?

- Bookmark this article.

- Mark your submission days on a team calendar.

- Assign a consistent point of contact on your side to handle submissions.

- And if you ever need help with the process, reach out—we’re here for you.

At Superior Trucking Payroll Service, we’re more than a vendor—we’re your payroll partner. Our job is to keep your drivers paid on time and your business moving forward without payroll surprises.

Written by Harley Houlden

Harley joined Superior Trucking Payroll Service (STPS) in early 2019. With nine years of customer service experience, she truly understands what it takes to make our clients happy. She loves working at STPS because of the family-like atmosphere. Harley’s favorite place to be is Traverse City, Michigan or anywhere that has hippos.