You’re Not Just Buying Payroll — You’re Buying Peace of Mind

Why would anyone pay more for something like payroll?

Are you actually saving money — or setting up future problems?

In this article, we’ll compare what you really get from Superior Trucking Payroll Service versus generic providers — and why some fleets gladly pay more for peace of mind.

You’ll see where other services fall short, what Superior Trucking Payroll Service includes that others don’t, and how to decide if it’s worth it for your fleet.

What Cheaper Payroll Services Might Miss

There are plenty of payroll options out there — ADP, Gusto, Paychex, QuickBooks, and more. These are big names and can do a lot. But here’s the truth:

Most payroll providers don’t truly understand trucking.

They might offer generic payroll tools, but when it comes to trucking-specific pay like mileage pay, stop off pay, or layover, they often need manual setup — or can’t do it at all.

If they get something wrong, here’s what can happen:

- Drivers get paid late or incorrectly.

- You fall out of IRS compliance.

- You spend time fixing errors instead of running your fleet.

- You risk audits and costly fines.

Why Superior Trucking Payroll Handles Your Pay Better Than Generic Providers

1. We Know Trucking — It’s All We Do

Superior Trucking Payroll Service is not a one-size-fits-all provider. We are focused on the trucking industry. That means we already understand:

- Per-mile & Per-load pay

- Detention & Layover pay

- Fuel reimbursements and accessorials

- How to pay W-2 drivers & owner-operators

You don’t have to train us or explain how your business works. We get it right away.

This isn’t just payroll — it’s trucking payroll.

2. We Handle Complex Pay Without the Headache

Trucking payroll can get messy. Drivers have different pay rates, routes change, and loads vary. We make all that easy by automating your payroll based on your real-world setup:

- Per-mile or hourly pay

- Per-stop or per-delivery bonuses

- Detention & layover pay

- Reimbursements for tolls or fuel

- Split pay between contractors and employees

You just give us the data, and we handle the rest.

3. Payroll Tax Compliance is Built In

One of the biggest headaches in trucking payroll is making sure you’re following all the tax rules — federal, state, and sometimes even local. Missing a filing or messing up a deduction can lead to penalties, audits, or angry drivers.

With Superior Trucking Payroll Service, you don’t have to worry about that.

We handle:

- Federal and state payroll tax filings and their payments

- Quarterly and year-end reports (like 941s and W-2s)

- 1099 processing for contractors

- Keeping up with tax law changes that affect the trucking industry

You run your trucks — they’ll make sure the taxes are filed and paid correctly.

No need to learn IRS forms or stress over due dates. We keep you in compliance and give you full reports so you always know where things stand.

4. Full-Service Means Less Work for You

With most big-name providers, you’re buying software — not a solution. You still end up spending hours setting up the system, inputting data, fixing mistakes, and trying to decode payroll tax rules.

That’s time you’re not spending on your drivers, your customers, or your bottom line.

Superior Trucking Payroll Service takes that weight off your shoulders. We don’t just give you a tool — we give you a team.

That means:

- Running payroll for you

- Mailing checks or setting up direct deposits

- Ensuring every pay stub reflects accurate load details

- Handling all your payroll taxes — from filing to payment

No more late nights, second-guessing your numbers, or stressing over compliance. You run your fleet. We’ll run your payroll — the right way.

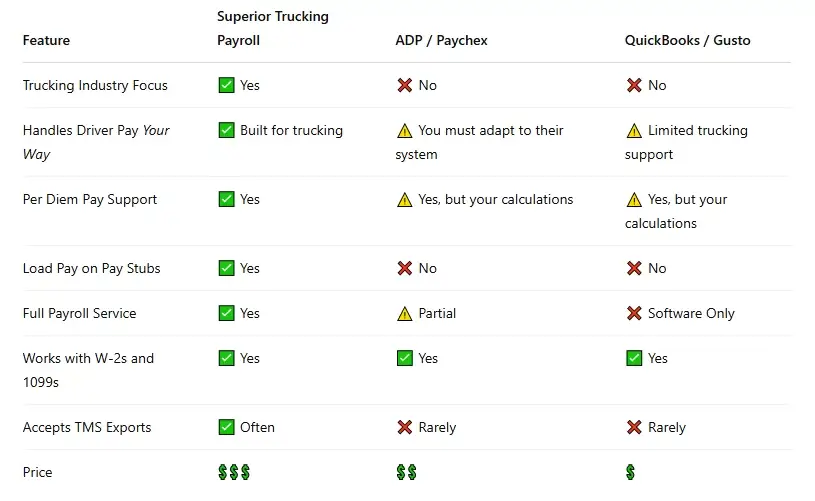

Superior Trucking Payroll Service vs Other Providers

Superior Trucking Payroll Service may cost more, but we also do more.

When a Cheaper Option Might Work

We’re not here to oversell — just to be honest.

If your operation is small and simple (say, a couple of salaried drivers), you might not need all the extras we provide.

In that case, something like QuickBooks or Gusto could get the job done at a lower price.

But if you:

- Run multiple trucks

- Use variable pay rates

- Cross state lines

- Work with contractors and employees

- Want help with IFTA, DOT, and IRS rules

…then Superior Trucking Payroll Service is likely worth every penny.

You Deserve a Payroll Partner That Gets Trucking

If you’re wondering whether Superior Trucking Payroll Service is worth the higher cost, here’s the answer: Yes — because we do it the right way, the trucking way. You’re not just buying payroll processing. You’re getting expertise, accuracy, and peace of mind.

You’ve got a business to run — loads to move, drivers to pay, and compliance rules to follow. While cheaper services might check a few boxes, they often require you to fit into their system. We build around yours.

Still unsure? Let’s take five minutes to compare your current setup to ours. No pressure, just real answers.

We’re Superior Trucking Payroll Service, and trucking is all we do. If you’re ready to stop chasing payroll issues and start getting it done right — we’re ready to help.

Written by Melisa Bush

With over 15 years of experience in the trucking industry, Melisa is well-versed in the complexities of trucking payroll and adept at navigating special circumstances. Before joining Superior Trucking Payroll Service, Melisa worked at a trucking company, where she managed driver miles and expenses for a fleet of 50 trucks. This hands-on experience gives her unique insight into the challenges our clients face when preparing their payroll data.