Are you 100% sure you’re handling per diem correctly in...

Read MoreIn the hustle and bustle of trucking life, Joe, the owner of Family Trucking, finds himself at a crossroads. As the engine of his business roars along the highways, he knows that managing finances efficiently is essential to keep his wheels turning smoothly. One significant financial decision looms large on Joe’s horizon – how should he manage payroll? Should he keep it in-house, or is it time to outsource? Let’s join Joe on his journey through the twists and turns of costs and benefits to find the best route for Family Trucking’s payroll.

Key Takeaways from this article:

- Joe, the owner of Family Trucking (a fictional company used for illustrative purposes), faces a critical decision between in-house payroll management and outsourcing.

- We delve into a cost analysis to aid Joe in making an informed choice for his company's financial health.

- Balancing control, time, and resources, Joe must weigh the benefits of each option to navigate Family Trucking's payroll journey effectively.

In-House Payroll: The Familiar Territory

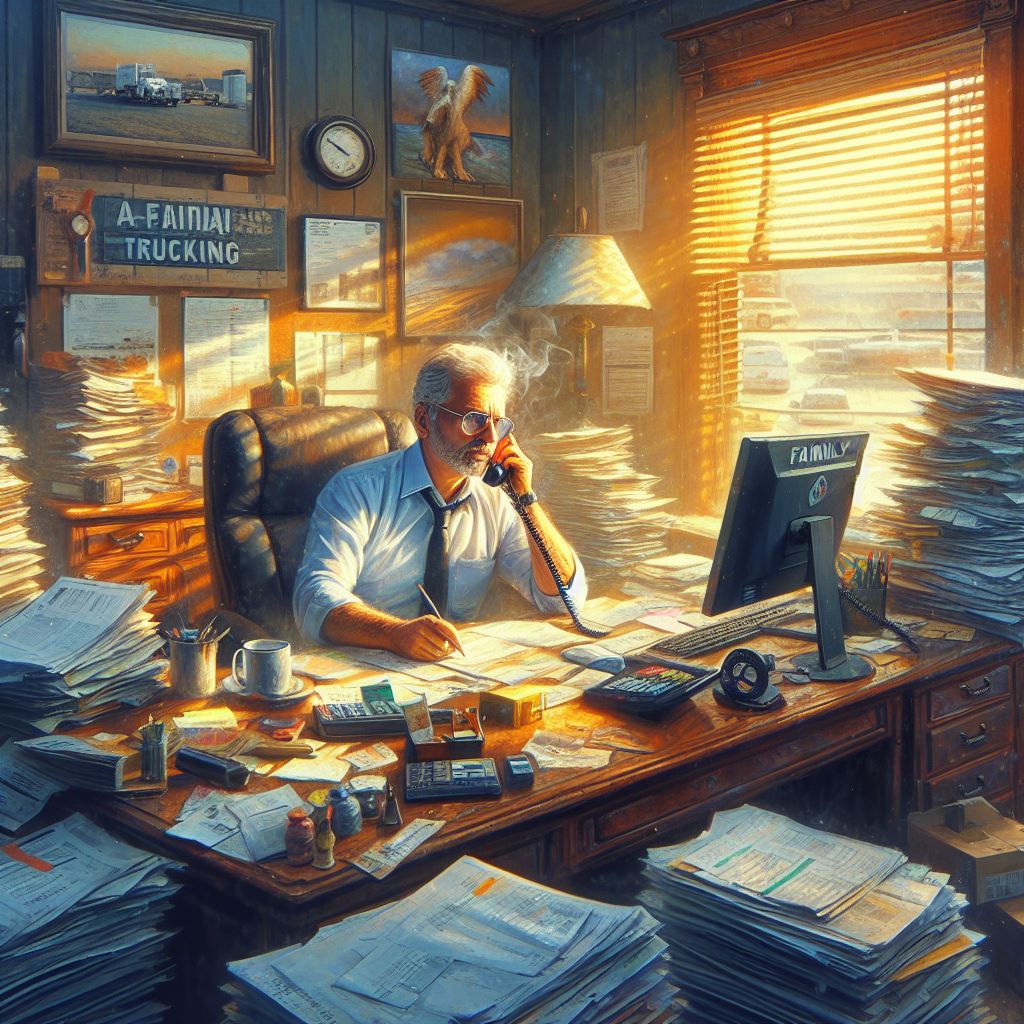

Picture Joe sitting at his cluttered desk, surrounded by paperwork and the hum of his office. This is Joe’s world of in-house payroll management. With in-house payroll, Joe feels in control. He knows every number, every deduction, and every dollar that flows through his company. But this control comes at a price – a price Joe knows all too well. Managing payroll in-house demands his time, his resources, and his expertise. There are software costs, employee salaries, and the constant threat of costly mistakes if he slips up. It’s like steering a big rig through a storm – challenging, but Joe knows he can handle it with the right skills and tools.

Outsourcing: A Beacon of Efficiency

Now, imagine Joe handing over the payroll reins to a trusted partner – an experienced payroll service provider like Superior Trucking Payroll Service. Suddenly, the weight lifts from Joe’s shoulders. No more late nights spent crunching numbers or fretting over compliance issues. Outsourcing offers Joe a smoother ride, allowing him to focus on what he does best – running his business. Superior Trucking Payroll Service becomes more than just a service provider; they become an ally, handling payroll with precision and care. And the best part? It often costs less than managing it in-house, freeing up Joe’s valuable resources for other essential tasks.

Comparing Costs: The Bottom Line

Let’s talk numbers. In-house payroll comes with direct expenses like software licenses, employee salaries, and administrative overhead. But Joe knows it’s the hidden costs that can catch him off guard – the time spent on payroll could be used for revenue-generating activities, impacting Family Trucking’s bottom line. One in three businesses pays a payroll tax penalty each year and the average penalty is over $800.00 as well. That’s time and expense he may not be able to afford. Outsourcing, however, offers a predictable, fixed cost structure. Joe pays a weekly fee to Superior Trucking Payroll Service, knowing exactly what to expect without worrying about unexpected expenses or compliance issues. It’s like paying for smooth roads instead of navigating potholes.

Choosing the Right Path: Factors to Consider

As Joe stands at the fork in the road, he must consider various factors. Scalability is crucial – can the chosen method grow with Family Trucking? Compliance requirements differ between in-house and outsourced payroll, so ensuring regulatory adherence is essential. Additionally, Joe should assess his internal resources and capabilities. Does he have the expertise and time to manage payroll efficiently in-house?

A Journey Worth Taking

In the end, there’s no one-size-fits-all solution for Joe and Family Trucking’s payroll needs. Each path – in-house or outsourcing – has its own merits and challenges. But armed with knowledge and a clear understanding of costs and benefits, Joe can navigate the payroll landscape with confidence. So, what’s the verdict? Whether Joe decides to steer the payroll ship in-house or enlist the help of Superior Trucking Payroll Service, one thing is certain – it’s a journey worth taking. With the right partner by his side, Joe can focus on what he does best: driving his business forward.

Ready to streamline your payroll process and drive your business forward? Contact Superior Trucking Payroll Service today to learn how we can help you save time and money while ensuring payroll accuracy and compliance. Let’s embark on this journey together.

Written by Mike Ritzema

Before founding Superior Trucking Payroll Service, Mike was the CFO of a trucking company with 80 trucks and a thriving brokerage. This experience gave him the perspective that a payroll solution has to make the lives of the office people better. All the solutions he has designed are to benefit everyone. Our company mission is to help trucking families and that includes the company owners, the drivers, and the office.

Contact Us!

Start-Up Trucking Company Payroll Help – No, You Are Not Too Small

Just Bought Your Second Truck? Now What? “How do I...

Read MoreWhat’s the Difference Between a Garnishment and a Friend of the Court (FOC) Order?

Have you ever looked at your paycheck and wondered, “Why...

Read MoreTrucking Payroll Tip: How To Handle Missing or Incorrect SSNs

What do you do if a truck driver gives you...

Read MoreDo You Have to Register for SUTA Before Running Your First Payroll?

Are you getting ready to pay your first employee? Not...

Read More