Ways We Look Out for Your Business From operating accounts...

Read MoreThe W-4 form is an essential document that determines how much federal income tax should be withheld from your paycheck. It’s crucial to fill out the form correctly to ensure accurate tax withholding. In this article, we will provide a step-by-step guide to help you navigate the process of filling out the W-4 form effectively.

(Disclaimer: this is not to be taken as tax advice. Since tax rules can vary by location, and industry, and can change over time, consult a CPA or tax advisor for specific guidance.)

The W4 may look different than you remember

Before 2020 the W-4 Form was titled “Employee’s Withholding Allowance Certificate,” but starting in 2020 the form stopped calculating ‘allowances’ so the title is now “Employee’s Withholding Certificate.”

The Personal Allowance Worksheet from page three of the previous form vanished and hasn’t been replaced, which was the next significant change to the W-4. Why? because personal exemptions were eliminated by the Tax Cuts and Jobs Act. Due to these exemptions, a taxpayer’s personal income could be deducted, which decreased their taxable income and federal income tax. Since the exemptions and allowances were linked, calculating the number of allowances is also no longer necessary because the exemptions are now gone.

Taxpayers who fill out the new version of the W-4 are less likely to wind up with a large tax bill or a giant refund when they file tax returns in the next year – money that could have been invested or spent on essential expenses throughout the year.

It is always optional to change your withholding percentage, however, the IRS advises that employees review their W-4 forms annually.

(Find the W-4 form here.)

The 5 steps in the 2023 W-4:

Now that we have explored the key differences in the new version of the W-4, it’s time to delve into the actionable steps you can take while filling it out. By following these steps, you can get through the W-4 with ease. Let’s dive in:

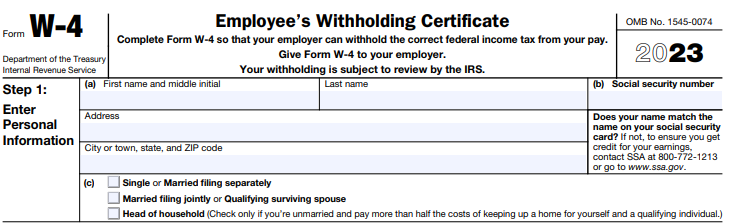

Step 1: Personal information

Start by entering your personal information, including your name, address, Social Security number, and filing status. Ensure that all the information provided is accurate and up to date.

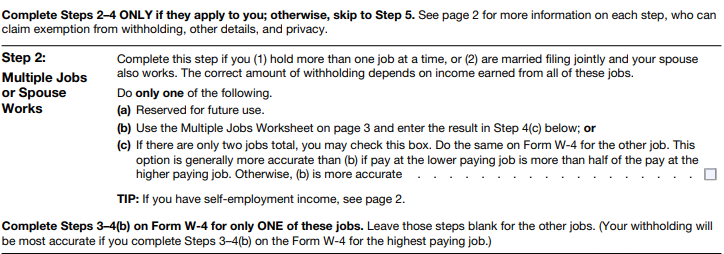

Step 2. Multiple jobs or spouse works

For step 2, employees only need to complete option (a), (b), or (c). Most commonly, this step is for anyone who has more than one job or is married filing jointly and whose spouse works.

Options (a) and (b) will take employees away from the form itself, but employees can complete option (c) right on the form. The IRS has stated that option (a) will give employees the most accuracy and privacy of the three. Option (b) also provides accuracy but requires manual work, and (c) is the least accurate since it assumes the jobs pay the same, but it’s the easiest to complete.

Checking box 2(c) tells your employer that you have multiple jobs. If you don’t want to disclose that fact, don’t check the box.

The form notes that individuals with multiple jobs should complete Form W-4 with the information from their highest paying job, which would result in the most accurate withholding.

(If you work more than one job, steps 3 through 4b should only be completed on one W-4 form.)

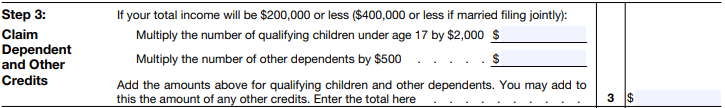

3. Claim dependents

Single taxpayers with a total income of $200,000 or less ($400,000 if married and filing jointly) are eligible for the child tax credit. The number of qualifying children under age 17 multiplied by $2,000 will go into the first box. The number of other dependents multiplied by $500 will go in the second box, and the sum of those two numbers will go on line 3.

Employees should pay attention to the definitions in IRS Publication 972 – Child Tax Credit if they’re looking to claim the credit.

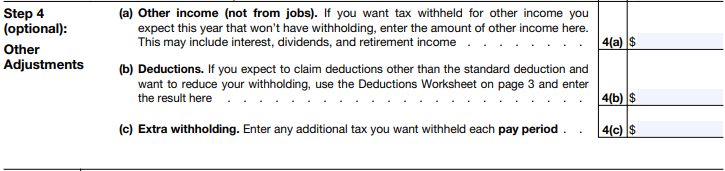

4. Other adjustments

This is an optional section of the W-4 which includes other income (not from jobs), deductions, and extra withholding. (a) Other income is an additional income that might not be subject to withholding, like retirement income or dividends.

(b) Deductions is for deductions other than the standard deduction. This includes all itemized deductions like mortgage interest and charitable contributions. It’s important to remember that, in general, the standard deduction reduces a taxpayer’s adjusted gross income to arrive at taxable income. So the greater the standard deduction or itemized deduction will help reduce the amount of tax due.

(c) Extra withholding is any extra withholding that the employee would like to withhold each pay period.

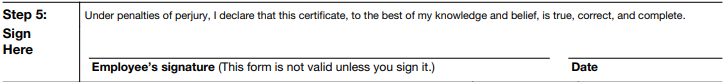

5. Sign and date the form

Review all the information provided on the W-4 form for accuracy. Once you are confident that everything is correct, sign and date the form. Failure to sign the form may result in processing delays or incorrect withholding.

6. Multiple jobs worksheet:

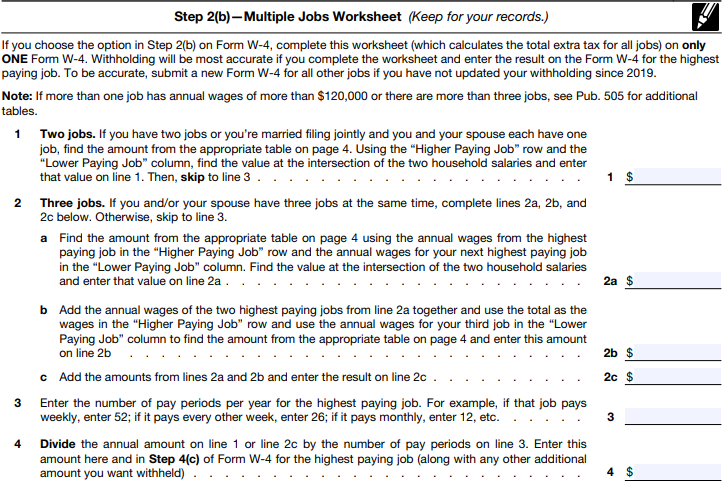

(You only need to complete this worksheet if you chose option b in step 2)

Line 1

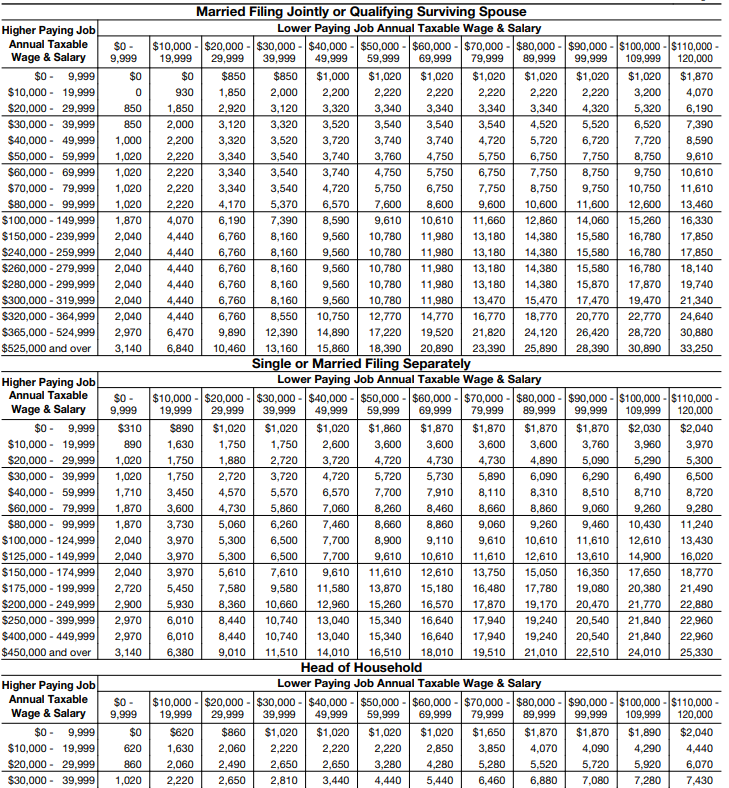

is for anyone who has two jobs or is filing jointly with a spouse who also works. Using the tables on page four, find the wages or salary for the ‘Higher Paying Job’ in the column on the left (see below) and cross-reference it with the number of wages or salaries from the ‘Lower Paying Job’ in the columns moving left to right.

At the intersection of these two amounts is the number you will enter on line 1. Keep in mind that there are separate tables for single and married filing separately, and head of household taxpayers, so make sure you’re using the right table.

Line 2

Is for someone who has three total jobs on their own or with a spouse.

Line 2a

For the two highest-paying jobs, you will use the correlating table to find the number that goes on this line.

Line 2b

The wages and salaries for the two highest-paying jobs need to be added together and found in the column on the left. You can find the wages and salaries for the third job in the row across the top of the table. The value at the intersection of those two figures will go on line 2b. The sum of lines 2a and 2b goes on line 2c.

Line 3

Is the number of pay periods per year for the highest paying job, this and Line 4 apply to everyone who chooses to fill out the Multiple Jobs worksheet.

Line 4

Simply divides the amount on either line 1 or 2c by the number of pay periods on line 3.

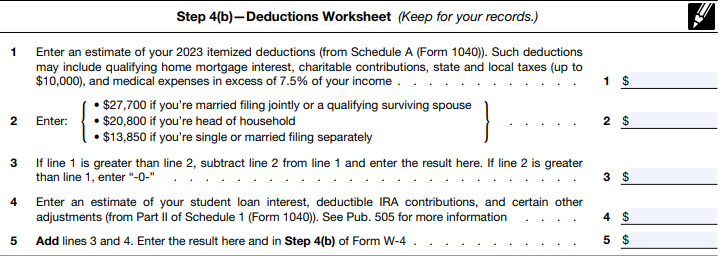

Deduction worksheet:

The deductions worksheet is for anyone who plans to itemize deductions. Since the implementation of the TCJA increased the standard deduction, far fewer people have been itemizing their deductions in recent years.

For 2023, if you believe your itemized deductions will exceed $12,950 (if you’re single or married filing separate), $25,900 (if you’re married filing jointly), or $19,400 (if you’re the head of household), you should consider filling out the deductions worksheet.

Anyone filling out this worksheet should have their prior-year tax return handy to help get a good idea of what those tax deductions might be.

In conclusion, filling out the W-4 form is an essential task for both employers and employees to ensure accurate tax withholding. By following the step-by-step instructions outlined in this article, you can confidently navigate the process and provide the necessary information to your employer. If you have any uncertainties or specific tax-related questions, it’s advisable to consult with a tax professional or utilize online resources provided by the IRS. By mastering the art of completing the W-4 form, you can take control of your tax withholdings and ensure a smooth tax filing experience.

Before coming to Superior Trucking Payroll Service, in 2011, Melisa worked for a trucking company with 50 trucks. She was the one who processed the driver’s miles and expenses.

Because of this experience, she understands the challenges our clients go through each week while preparing their payroll data for us. Customer service is #1 for Melisa. Her goal is to treat our clients like people with true and real needs, not just another number.

Contact Us!

Driver Retention Tips

One of the biggest problems for businesses in the world...

Read MoreHow to Avoid Payroll Errors and Penalties in the Trucking Industry

Are you tired of dealing with payroll issues in the...

Read MoreWhy Was No Income Tax Taken Out of my Paycheck?

Why Was No Income Tax Taken Out of my Paycheck?...

Read MoreUnderstanding Supplemental Payroll Fees: What They Are and Why They Matter

Are you a business owner trying to understand the complexities...

Read More