Have you ever checked your paycheck and noticed money missing?

Did you know your employer can be legally required to take part of your wages to pay a debt?

Wage garnishment can be confusing, stressful, and financially overwhelming. If your paycheck is smaller than expected, you might be wondering why this is happening, how much can be taken, and if there’s anything you can do to stop it.

The good news is you do have options. In this article, we’ll break it all down in simple terms. By the end, you’ll understand what wage garnishment is, how it works, and what steps you can take to protect your paycheck.

What is a Wage Garnishment?

Wage garnishment is when a court orders your employer to take money out of your paycheck to pay a debt. Your employer then sends that money directly to the person or company you owe.

This continues until the debt is paid off or you take legal steps to stop it.

Common Reasons for Wage Garnishment

Not all debts lead to garnishment, but some common reasons include:

- Child support or alimony

- Unpaid credit card bills

- Back taxes (federal, state, or local)

- Medical bills

- Federal student loans

- Other loans

Your employer cannot garnish your wages without a court order. For most debts, a creditor must first sue you, win in court, and receive a garnishment order before your employer can withhold money from your paycheck.

However, some debts don’t require a lawsuit. If you owe back taxes, the IRS can initiate garnishment without going to court, but they must first notify you of the amount owed and provide an opportunity to resolve the debt.

Child support is court-ordered. Family court determines the payment amount, and the employee is notified of a court date where the decision is made. Once the court establishes the payment order, the employer is then legally required to withhold the specified amount from wages until the court sends notification to stop.

How Does Wage Garnishment Work?

-

Creditor Takes You to Court

If you don’t pay your debt, the company you owe can sue you.

-

The Court Rules Against You

If the judge agrees with the creditor, they issue a wage garnishment order.

-

Employer Gets the Order

Your employer is legally required to take the money from your paycheck.

-

Money is Sent to Creditor

Your employer sends the garnished amount directly to the creditor each payday.

How Much Can Be Garnished? (Limits & Protections)

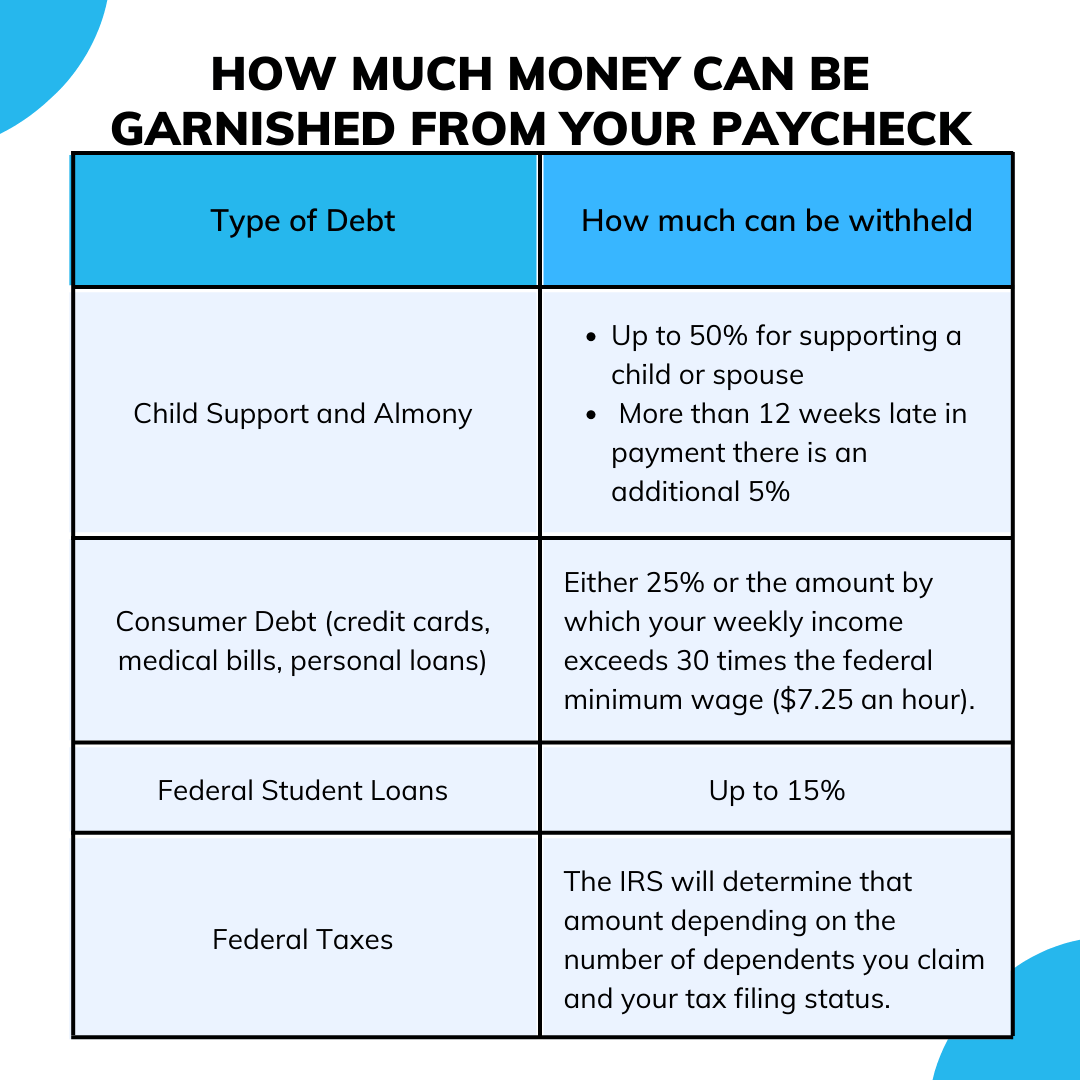

There are laws to protect your paycheck from being completely taken away. The amount that can be garnished depends on the type of debt and how much money you make.

Federal Garnishment Limits

The Consumer Credit Protection Act (CCPA) sets limits on how much can be garnished from your disposable income (the money left after taxes and necessary deductions).

How to Stop or Avoid Wage Garnishment

If your wages are being garnished (or you think they might be soon), you do have options. Here’s what you can do:

Negotiate with the Creditor

- Call and ask for a payment plan before garnishment starts.

- Offer to make small monthly payments that fit your budget.

- This works best if you act before a court order is issued.

File a Claim of Exemption

In some cases, you can fight the garnishment by claiming a hardship. For example, if you:

- Support a child or elderly relative

- Have very low income

- Are being overcharged

You’ll need to fill out a form and provide proof of your financial situation. A judge will decide if your request is approved.

Dispute the Garnishment

If you believe the garnishment is wrong or unfair, you can challenge it in court. Common reasons to dispute a garnishment:

- Set up a debt management plan

- Negotiate lower payments with creditors

- Consolidate your debt into one monthly payment

Consider Bankruptcy (Last Resort)

If you can’t afford payments and have overwhelming debt, bankruptcy may temporarily stop garnishment and help you rebuild your finances.

⚠️ Warning: Bankruptcy can hurt your credit score for years, so talk to a financial expert first.

Take Control of Your Finances

Wage garnishment can feel overwhelming, but now you understand what it is, how it works, and what steps you can take to stop or avoid it.

If your wages are being garnished, it means a creditor or agency is collecting money you owe—whether for child support, taxes, or another debt. But you have legal rights, and there are ways to reduce the impact on your paycheck.

Start by reviewing your garnishment notice to understand who is collecting the debt and how much is being withheld. Then, consider your options:

- Negotiate with creditors before garnishment begins.

- File a claim of exemption if you qualify for hardship.

- Work with a credit counselor to find a manageable payment plan.

- Challenge the garnishment if it’s incorrect.

- Seek legal or financial advice if you’re unsure about your next steps.

If you’re an employer, you play a critical role in wage garnishment. Once you receive a court order, you’re responsible for processing garnishments correctly and ensuring timely payments. Failing to follow legal requirements can lead to penalties, compliance issues, and employee concerns.

At Superior Trucking Payroll Service, we help trucking companies manage garnishments efficiently through payroll processing. We handle calculations, deductions, and payments—so you stay compliant and avoid unnecessary risks.

Your next step: Read our article “Understanding Garnishments and Their Payment” to learn how to properly manage garnishments and streamline the process.

Let us handle the complexities so you can focus on keeping your trucks on the road.

Written by Melisa Bush

With over 15 years of experience in the trucking industry, Melisa is well-versed in the complexities of trucking payroll and adept at navigating special circumstances. Before joining Superior Trucking Payroll Service, Melisa worked at a trucking company, where she managed driver miles and expenses for a fleet of 50 trucks. This hands-on experience gives her unique insight into the challenges our clients face when preparing their payroll data.

Melisa’s top priority is customer service. She strives to treat each client as an individual with genuine needs, rather than just another number in the system. Her goal is to alleviate the burdens of our clients and make their daily operations smoother.