Just Bought Your Second Truck? Now What? “How do I...

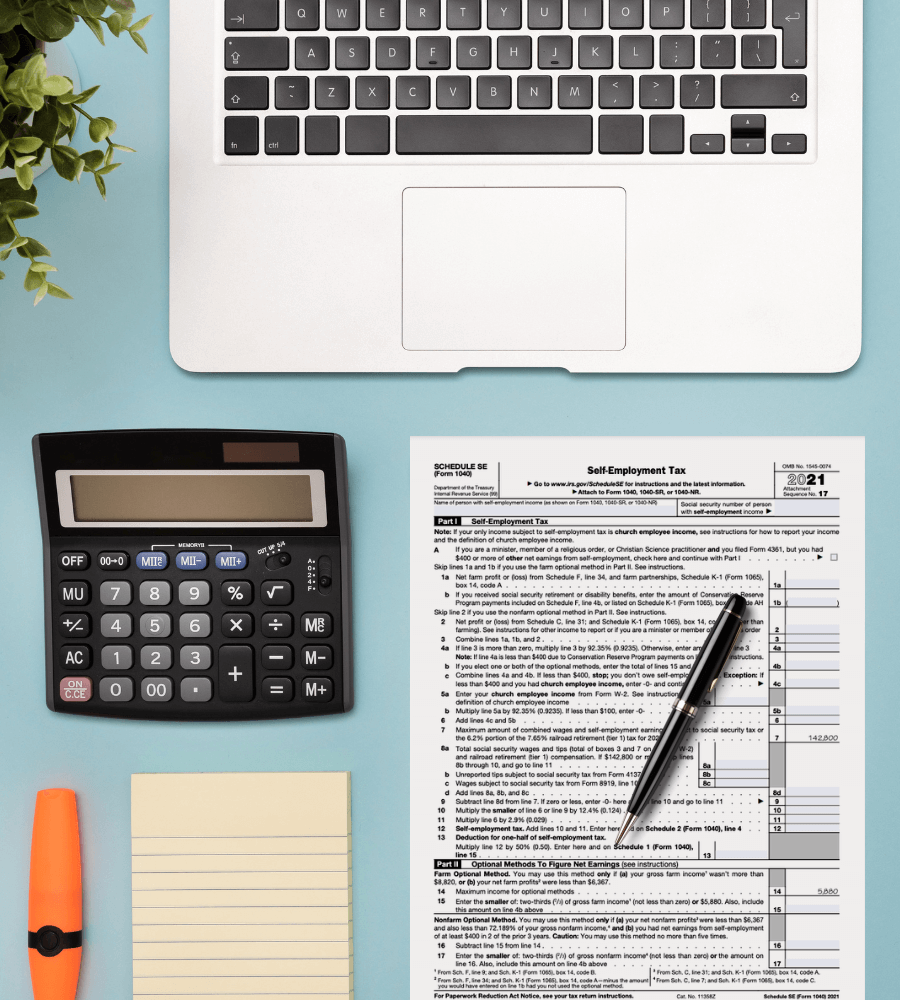

Read MoreAs an owner-operator, you are responsible for paying your Federal and State taxes yourself in April. You must make estimated tax payments at the end of each quarter, often in the range of 20-30% of the net income received over the quarter.

This article is for general purposes only and not a comprehensive guide for taxes and your owner-operator business. The best way to ensure you’re taking advantage of deductions and paying appropriate taxes is by following the IRS.gov regulations and consulting with a tax professional.

Self-employment taxes: are similar to the Social Security and Medicare taxes that are paid by a company employee. According to IRS.gov, the self-employment tax rate is 15.3%.

Federal Income Tax & State Income Tax: This is calculated on your tax return. As a company employee, income taxes were estimated and withheld from your check. As an owner-operator, you are responsible for its estimation and payment.

If you expect to owe at least $1,000 in taxes after subtracting withholding and credits, you must make quarterly payments of self-employment and income taxes. For payment vouchers, addresses for where to send the IRS estimated payments, and other federal tax information, visit IRS.gov.

Each state that imposes income taxes has a website to obtain payment vouchers and addresses.

Owner-operators have to estimate the profit of their business so that they can make estimated tax payments. The profit is also used to calculate the taxes due at the end of the year when you file Form 1040. The profit equation you should use is:

Gross Pay (as reported on 1099-Misc) – Allowable Business Expenses = Net Profit

If you fail to show deductions or file a tax return, the IRS will determine the taxes that are due, without considering any of your potential deductions. This amount will most certainly be much higher than you otherwise would have been required to pay.

• Interest paid on business loans

• Depreciable property

• Home office

• Insurance Premiums

• Retirement plans

• Start-up costs

• Supplies

• Permits and license fees

• Travel

• Truck lease

• Accounting services

• Communication equipment

• Truck repairs and accessories

The main criteria in determining whether something is deductible is whether or not you have a record of the expense, and if it is considered an ordinary and necessary business expense.

Contact Us!

What’s the Difference Between a Garnishment and a Friend of the Court (FOC) Order?

Have you ever looked at your paycheck and wondered, “Why...

Read MoreTrucking Payroll Tip: How To Handle Missing or Incorrect SSNs

What do you do if a truck driver gives you...

Read MoreDo You Have to Register for SUTA Before Running Your First Payroll?

Are you getting ready to pay your first employee? Not...

Read MoreIncomplete Truck Driver Paperwork: How It Can Cost You Big

Have you ever felt pressured to get a new driver...

Read More