Are you curious about the cost of our payroll services...

Read MoreEvery business needs some way to pay its employees. Employers have many options for getting their employees’ money to them. Also, it’s good to have options for employees so you can make sure that they feel comfortable in the way they get their money so you can keep them at your company. This is critical when it comes to hourly workers, considering that their pay is different every pay period. Employees can be compensated through a paper check, direct deposit, pay cards, or cash. This can make payroll a little difficult. Let’s do a deeper dive into why there are so many options.

First, in some states, you could be fined if you don’t have a minimum of two different ways to pay your employees. Secondly, 61% of people in the United States are living paycheck to paycheck which means that they need their money distributed in a way that suits them. They might need advanced payments. And thirdly, almost a quarter of American households are underbanked or unbanked. This means they will probably need to be paid in a paper check or in cash.

Now looking at these facts you can see why it’s important to have the right options to pay your employees quickly and efficiently to keep them at your company. If you don’t have the payment option that your employee might need then they will leave your company and you would lose great talent.

The four ways to pay your employees are very different so if you are looking for which options to have available for your employees then this information will help you figure it out by knowing what their needs are and finding out which option would compensate for those needs.

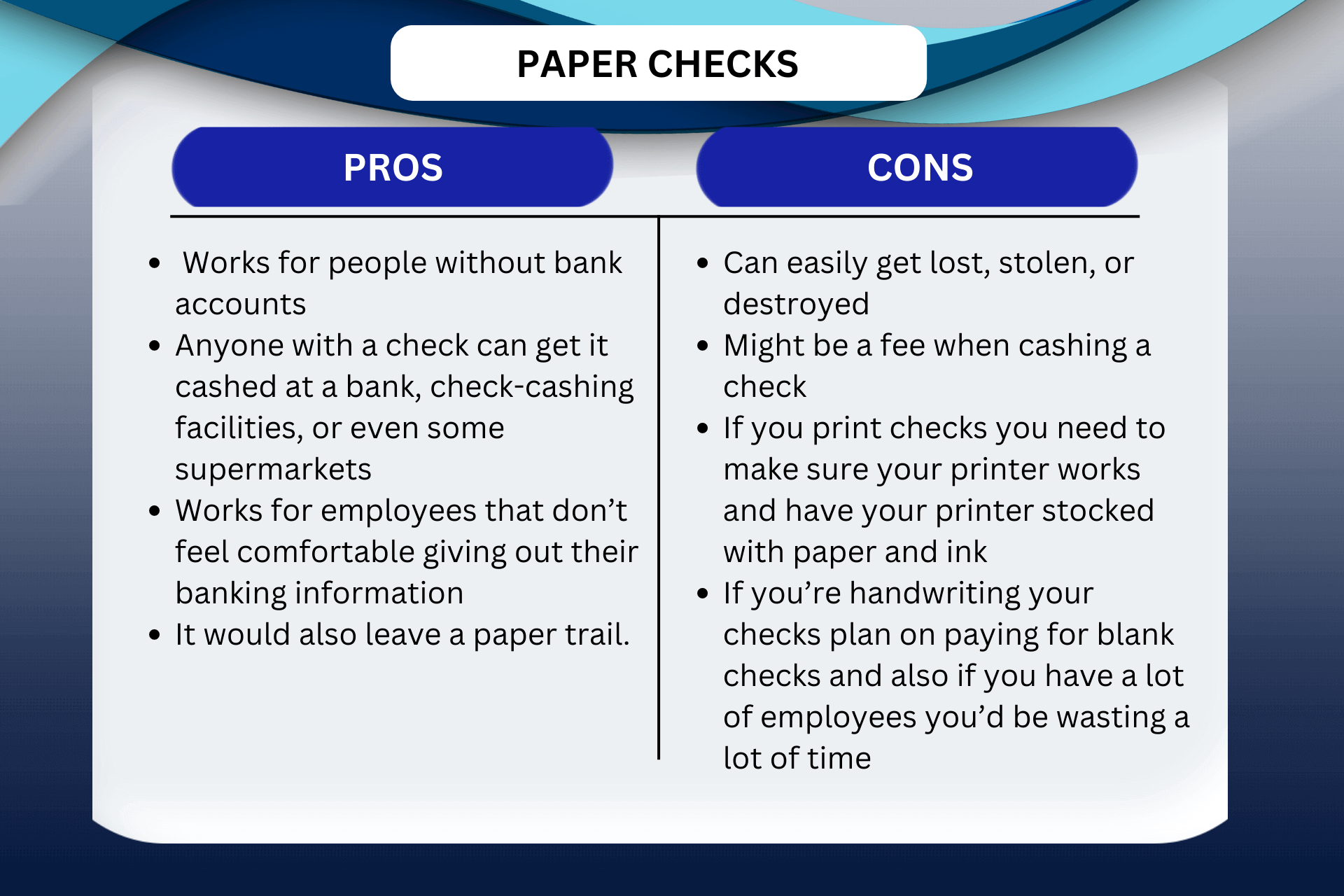

Paper Checks

Paying employees with checks is one of the most common methods of payment. They can be handwritten or printed. Paper checks can be the best option for people without bank accounts. Unlike direct deposit where you need to have a bank account to get paid, anyone with a check can get it cashed at a bank, check-cashing facilities, or even some supermarkets. It’s also good for employees that don’t feel comfortable giving you their banking information. It would also leave a paper trail.

Before making this option for your payment method, consider the cons. Checks can easily get lost, stolen, or destroyed.

Some places where you can cash your checks may even make non-accountholders pay a fee. Also, if you’re printing checks you constantly need to make sure your printer works and have your printer stocked with paper and ink to make sure that your employees aren’t waiting to get paid. If you’re handwriting your checks plan on paying for blank checks and also if you have a lot of employees you’d be wasting a lot of time.

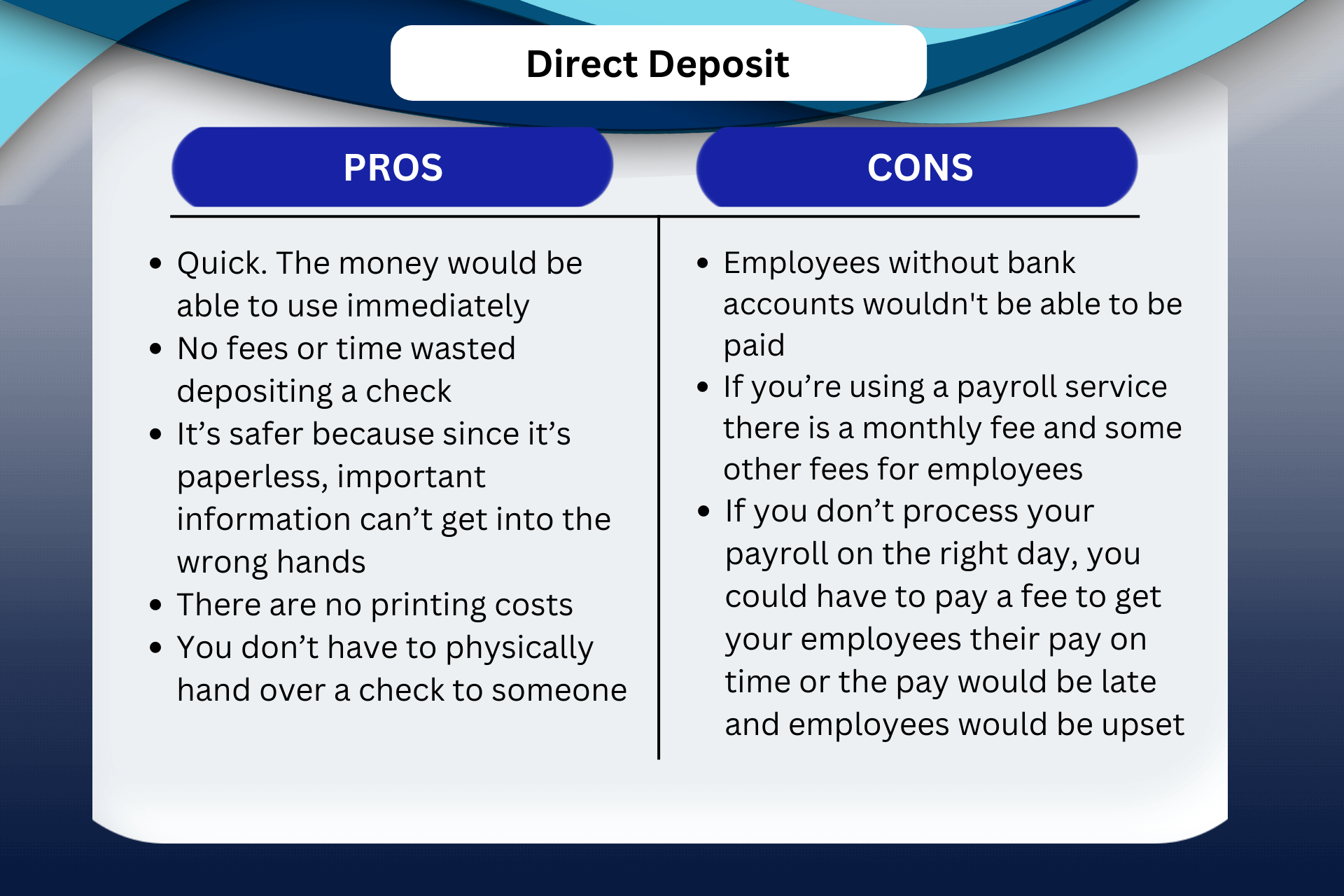

Direct Deposit:

Direct deposit is rated the most popular payment method. Over 93% of United States employees have chosen to be paid this way. Getting paid via direct deposit is one of the quickest ways. Funds are being transferred right into your employees’ accounts so there is no middle card like a pay card and there are no fees or time wasted depositing a check. The money would be able to use immediately. It’s safer because since it’s paperless, important information can’t get into the wrong hands. There are no printing costs you don’t have to physically hand over a check to someone, which makes things a lot easier for companies that have employees in other states, working remotely, on vacation, or are just too busy or forgetful to go to the bank.

There are cons to direct deposit though. If your employees don’t have bank accounts they wouldn’t be able to receive their money. If you’re using a payroll service there is a monthly fee and some other fees for employees. If you don’t process your payroll on the right day, you could have to pay a fee to get your employees their pay on time or the pay would be late and employees would be upset. Especially the employees that are living paycheck to paycheck.

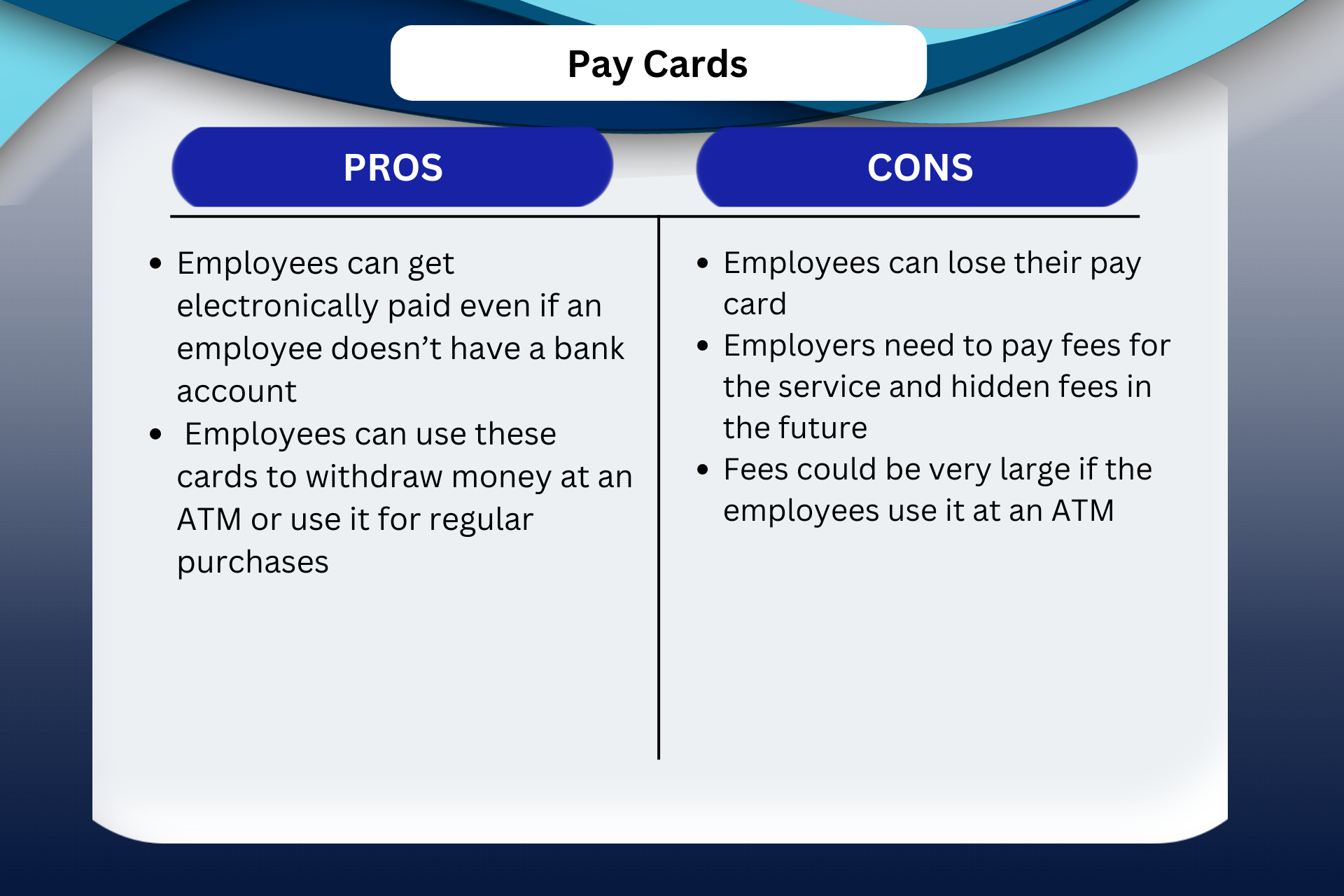

Pay Cards:

Pay Cards are the most recent payment option. It includes funds being deposited into an account that is useable as a prepaid debit card. This is a way where employers can pay all their employees electronically even if one of the employees doesn’t have a bank account. It allows your employees to get the benefits of being paid electronically but avoid the cons of direct deposit. Employees can use these cards to withdraw money at an ATM or use it for regular purchases. There are only a few cons while using pay cards. These include people losing their pay card, employers having to pay fees for the service and hidden fees in the future, and if employees use it at an ATM the fees could be pretty large.

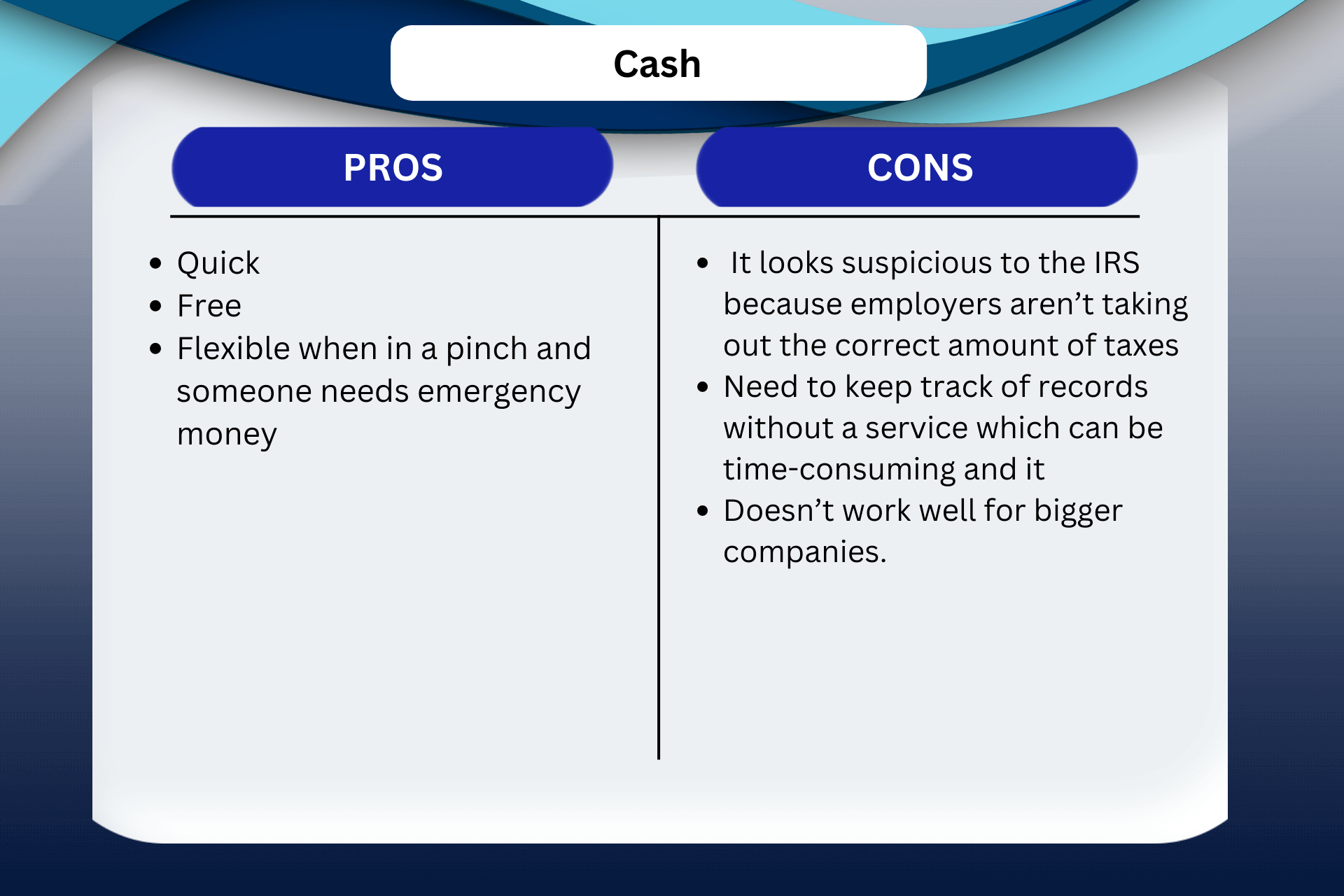

Cash:

The last payment option is just straight cash. This is not a very good option for payment. It definitely raises a red flag to the IRS. It looks suspicious to them because you aren’t taking out the correct amount of taxes. You also have to keep track of your record yourself which can be time-consuming and it definitely doesn’t work well for bigger companies. Yes, it is quick, free, and flexible when you’re in a pinch and someone needs emergency money but it is not worth the risks that come with it. The cons definitely out weight the pros.

Paystubs:

Do not forget about paystubs. Think of paystubs as receipts that show the employees that you paid them. They show employees their gross pay, net pay, and deductions. Paystubs are complicated in some ways. Make sure that you check with the legislation of your state because even if you’re trying to go paperless with direct deposit or a pay card, some states require paper paystubs.

Bottom Line:

All of these payment methods could be the right one for you. They all have their pros and cons which gives you the option to choose whichever payment option works well with your company and your employees, so they will be happy with their way of payment and feel comfortable with staying at your company. I would definitely recommend offering two different payment options so the employees can feel the most comfortable, and it meets all of their needs.

Written by Tessa Braybrook

Tessa joined Superior Trucking Payroll Services in September of 2022 after graduating with a Bachelor’s degree in multimedia journalism from Grand Valley State University. She has a passion for writing and binge-watching TV series.

Contact Us!

Solving Paycheck Problems with Payroll Cards

Key Takeaways in this article: What are pay cards? Benefits...

Read MoreNavigating Delays in Payroll Communication

Are you tired of waiting endlessly for your payroll provider...

Read MoreAI, BEC and more: 5 cybersecurity & fraud trends in 2024

Ways We Look Out for Your Business From operating accounts...

Read MoreDriver Retention Tips

One of the biggest problems for businesses in the world...

Read More