Ways We Look Out for Your Business From operating accounts...

Payroll Outsourcing Challenges

Payroll outsourcing has been a well-liked tactic for companies looking to boost productivity and simplify internal payroll administration. Although the advantages are clear, there are certain difficulties with this strategy. In this post, we’ll examine some of the typical concerns that companies may run into while outsourcing payroll and talk about solutions.

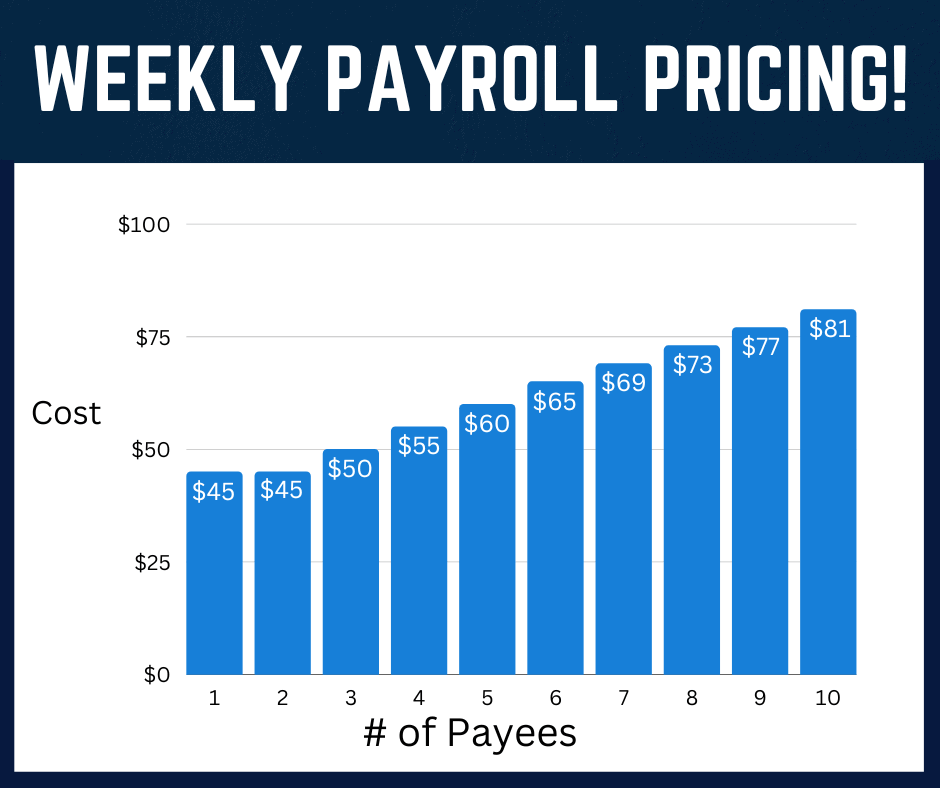

Outsourcing Payroll Cost:

Generally, you can expect to pay around $150-$200 per employee for the entire year when you outsource your payroll. Now, compare this to the midpoint salary to hire an in-house payroll processor at your company, which averages a $40,206 annual salary.

There may also be additional costs with outsourcing your payroll depending on what extra services you may need. For example, at Superior Trucking Payroll Service, we include payroll tax filing and direct deposit in our base price. Other companies may charge extra for these services.

Other additional services we include with our payroll package are quarterly and year-end reporting, emailed paystubs and more depending on the client.

We do charge an extra fee for next-day pay submission, which ranges from 50% to 100% of the payroll service fee, depending on when the pay data was submitted.

Customization Challenges:

Payroll requirements vary widely among companies, therefore a one-size-fits-all approach might not be sufficient. Sometimes customization is a challenge for outsourcing providers, which results in errors and inefficiency. It is crucial for businesses to effectively explain their unique needs.

At Superior Trucking Payroll Service, we make sure that your company has a one of a kind payroll plan that is customized to your specific needs. Check out our Services page here.

Is it going to take longer to communicate payroll changes?

With outsourcing, you’ll need to plan ahead in order to meet the strict deadlines set by your payroll company so that they can turn around and process payroll on time. That means taking into account things like holidays, your payroll account manager being out of the office, weather, or even glitches in your technology that impact data transfers.

If you’re like some businesses, especially if you only have time to focus on the payroll after hours, you may worry that the time gap between when you send something over to your vendor. The fear is they will receive your data without enough time to process which could lead to delays in payment to your employees.

To ensure that there are no delays in your payroll you can create a schedule, or opt for payment options other than paper checks. At Superior Trucking Payroll Service, most of our clients’ employees prefer direct deposit for their funds.

Effective communication is essential to processing payroll successfully. Errors, late payments, and dissatisfaction among employees can arise from misunderstandings between the company and the outsourcing provider. It is important to establish clear communication channels and protocols. Here at Superior Trucking Payroll Service our clients are assigned to a specific processor who will take care of their weekly needs.

Data Security Concerns:

There are legitimate worries regarding data security when entrusting sensitive payroll data to an outside source. Data breaches can have severe effects on one’s reputation and legal standing. Businesses must carefully evaluate the security procedures and policies of their outsourcing partner.

Compliance Risks:

Processing payroll is closely related to following tax laws and regulations. To minimize compliance risks, outsourcing providers need to stay up to date on these constantly changing laws. Companies need to be sure that their partner has an understanding in local, state, and federal regulations.

Scalability Issues:

Businesses’ payroll requirements change as they expand. An outsourcing partner who isn’t scalable may end up being more of a problem than a solution. Businesses need to select providers that can adjust to the increase of complexity that comes with business expansion.

System Compatibility:

We understand the need for seamless integration and always work with our clients to ensure a smooth implementation. If you’re worried about your transportation management system (TMS) not integrating with our payroll processes, don’t. You don’t have to be using a TMS to use us. But if you are looking for a one, we have partnered with one of the best and most well-known transportation management systems to create a perfect match. AscendTMS uses a world-class 100% cloud-based TMS software where you can manage every aspect of your trucking and logistics operations. The best part is AscendTMS integrates directly with us.

Bottom Line:

We understand most companies have concerns when it comes to outsourcing payroll. It can be a very stressful time. Because of these concerns we strive to be as transparent, and as helpful, as possible with our clients and future clients. At Superior Trucking Payroll Service we are constantly learning and improving in order to make your life easier by taking payroll off of your plate. After all, our goal is to help trucking families! Trucking Families’ include business owners, office employees, shop or warehouse employees, and truck drivers.

With over 20 years of experience in entrepreneurship, management, business planning, financial analysis, software engineering, operations, and decision analysis, Mike has the breadth and depth of experience needed to quickly understand entrepreneurs’ businesses and craft the most suitable solutions.

Before founding Superior Trucking Payroll Service, Mike was the CFO of a trucking company with 80 trucks and a thriving brokerage. This experience gave him the perspective that a payroll solution has to make the lives of the office people better. All the solutions he has designed are to benefit everyone. Our company mission is to help trucking families and that includes the company owners, the drivers, and the office.

Contact Us!

Driver Retention Tips

One of the biggest problems for businesses in the world...

How to Avoid Payroll Errors and Penalties in the Trucking Industry

Are you tired of dealing with payroll issues in the...

Why Was No Income Tax Taken Out of my Paycheck?

Why Was No Income Tax Taken Out of my Paycheck?...

Understanding Supplemental Payroll Fees: What They Are and Why They Matter

Are you a business owner trying to understand the complexities...