Ways We Look Out for Your Business From operating accounts...

Read MoreAs we step into 2024, the payroll and tax environment undergoes dynamic shifts, bringing forth new regulations, policies, and changes that significantly impact businesses. In this article, we’ll delve into the latest updates in payroll and tax regulations for 2024, equipping businesses with the knowledge they need to navigate these changes seamlessly and ensure compliance in the evolving fiscal terrain.

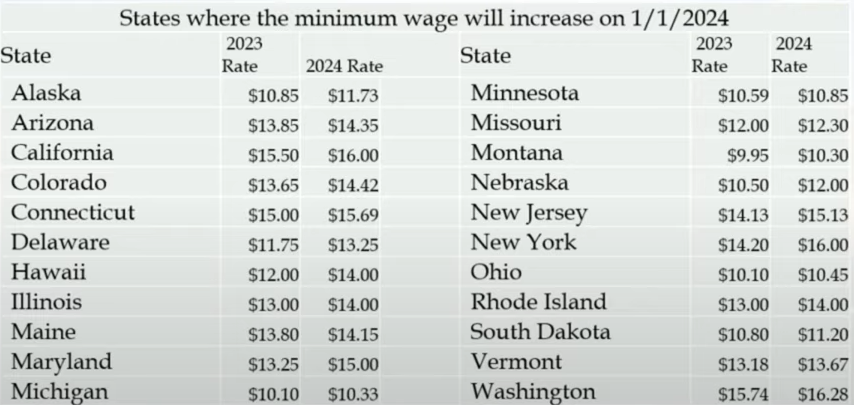

Minimum Wage Change

If your state is not on the chart it means that your state’s minimum wage did not go up.

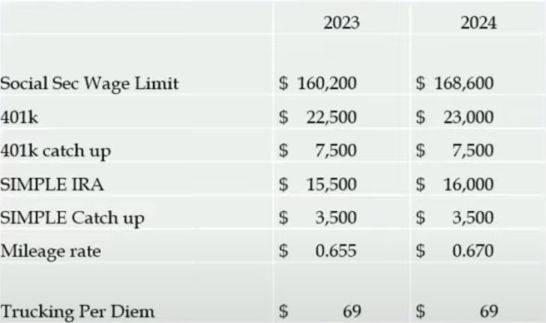

Yearly Changes

These change every year. If you are over 50 years old you can qualify for the 401k catch up or the SIMPLE IRA catch up.

Per Diem did not change. If you want to know more about per diem, watch our webinar by clicking on the link below.

What Changes are Coming for Payroll in 2024? Tax Rates?

- New Forms W-4 and I-9

- Federal Income Tax Brackets move up about 5.4%

- Alabama – No tax on Overtime Pay

- California – OT Threshold is 2x min wage

- California – Fast Food Minimum Wage is $20.00

- Illinois – Paid Leave

- Maryland – Paid Family Leave (10/1/24)

- Minnesota – Pay History Ban

- New York – Salary Threshold Goes UP to $1300/week in March

- Vermont – Child Care Tax

Before founding Superior Trucking Payroll Service, Mike was the CFO of a trucking company with 80 trucks and a thriving brokerage. This experience gave him the perspective that a payroll solution has to make the lives of the office people better. All the solutions he has designed are to benefit everyone. Our company mission is to help trucking families and that includes the company owners, the drivers, and the office.

Contact Us!

Driver Retention Tips

One of the biggest problems for businesses in the world...

Read MoreHow to Avoid Payroll Errors and Penalties in the Trucking Industry

Are you tired of dealing with payroll issues in the...

Read MoreWhy Was No Income Tax Taken Out of my Paycheck?

Why Was No Income Tax Taken Out of my Paycheck?...

Read MoreUnderstanding Supplemental Payroll Fees: What They Are and Why They Matter

Are you a business owner trying to understand the complexities...

Read More