Ways We Look Out for Your Business From operating accounts...

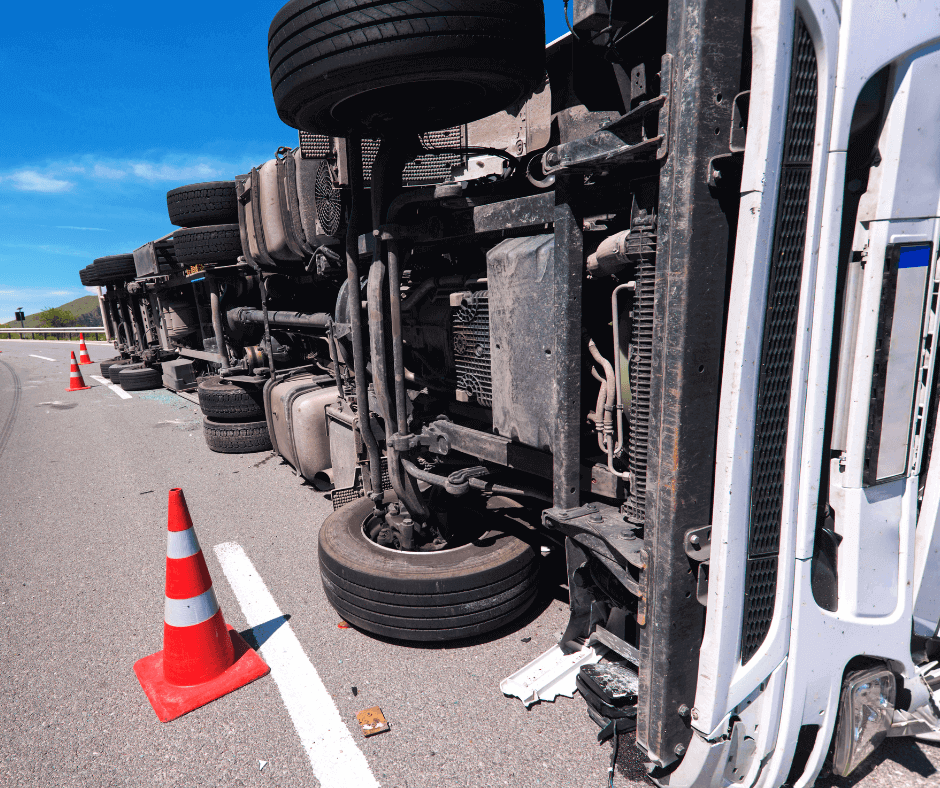

Read MoreTruck driving is a dangerous profession. Approximately 4,600 fatal semi-truck driver accidents occur each year. Every year, about 182,000 individuals are hurt in collisions involving heavy trucks and buses. Because semi trucks are substantially bigger than regular trucks, they are frequently involved in accidents that result in serious injuries.

Disclaimer: This article is meant to be a general overview of paying a deceased employee. Consult your attorney or tax professional before you make any decisions to ensure that you are following local laws.

Dealing with the passing of an employee is a difficult and sensitive situation for any employer. It’s essential to handle such matters with compassion, respect, and adherence to legal and ethical requirements. Countless questions quickly arise. Questions like: How do we announce it to our employees and/or clients? How much information can we share? How can we best serve that employee’s family while still following the appropriate laws and internal procedures? Processing a final paycheck for a deceased employee involves several steps to ensure a smooth and respectful procedure.

1. Payment made by direct deposit after death

It may not seem like a big deal when you are hiring a new driver, but it’s extremely important to ensure your direct deposit form has the future in mind. It needs to acknowledge the need and provide the authorization to make corrective withdrawals. Worst case scenario, you are set up on automatic payments and cannot stop a direct deposit before it is made. Through corrective withdrawal, you can reissue the check to the correct party and recalculate the taxes.

2. Live check issued before death, not cashed

A live paycheck issued to an employee who passed away before cashing the check needs to be stopped. Whether you void or cancel the check, it does not matter. To reissue the check, you will need information pertaining to the beneficiary or the employee’s estate.

A. Last paycheck issued the same year of death

Any wages in the same tax year as an employee’s death, paid to the beneficiary or the employee’s estate, are subject to change. Federal Income Tax (FIT) is no longer withheld, but Medicare and Social Security remain withheld under the Federal Insurance Contribution Act (FICA).

When the employee’s W-2 is issued, the taxable wages will not be reflected in Box 1. They will be noted in Box 3 (social security wages) and Box 5 (Medicare wages and tips). The taxes withheld for social security and medicare will be reflected in Box 4 and 6 respectively. This is to ensure appropriate credit. You, the employer, should also issue a 1099-MISC form to the employee’s beneficiary or estate noting the gross wages paid in Box 3.

B. Last paycheck issued the year after death

Payment of wages issued to a beneficiary or the employee’s estate in the tax year following the employee’s death, are neither subject to FIT withholding nor FICA withholding.

In this scenario, you most likely will not be issuing a W-2. However, if you decide to issue one, none of the wages paid after the employee’s death should be noted in Box 1, 3, or 5 of the W-2. There should be no taxes withheld from this payment to reflect in Box 2, 4, or 6. You should issue a 1099-MISC form to the employee’s beneficiary or estate noting the gross wage paid in Box 3.

Keep in mind, states also have varying laws that provide stipulations for who should receive wage payments and whether or not state income tax withholdings apply.

Bottom line:

Navigating the delicate process of processing a final check for a deceased employee demands both legal compliance and sensitivity. This is particularly vital in the unpredictable world of the trucking industry, where safety is a very important concern. To ensure a smooth procedure, it’s wise to have direct deposit forms that can accommodate future corrective withdrawals. Understanding the tax implications of payments made in the same year versus the following year after an employee’s death is essential. Keep in mind that state laws can add further complexity to this process. Seeking guidance from legal and financial experts is advisable to provide both legal compliance and support to the employee’s family during these difficult times.

Written by Mike Ritzema

With over 20 years of experience in entrepreneurship, management, business planning, financial analysis, software engineering, operations, and decision analysis, Mike has the breadth and depth of experience needed to quickly understand entrepreneurs’ businesses and craft the most suitable solutions.

Contact Us Here!

Driver Retention Tips

One of the biggest problems for businesses in the world...

Read MoreHow to Avoid Payroll Errors and Penalties in the Trucking Industry

Are you tired of dealing with payroll issues in the...

Read MoreWhy Was No Income Tax Taken Out of my Paycheck?

Why Was No Income Tax Taken Out of my Paycheck?...

Read MoreUnderstanding Supplemental Payroll Fees: What They Are and Why They Matter

Are you a business owner trying to understand the complexities...

Read More