Top 3 Advantages of Paying Truck Drivers W-2 Instead of 1099

When it comes to paying truck drivers, there is a lot of debate between W-2 and 1099 forms. W-2 is unquestionably the best way to pay the drivers if they are employees, but many trucking businesses frequently pay 1099 instead for contract workers. Many businesses engage in this behavior while being fully aware of the severe financial penalties they risk if discovered. That may not be enough to persuade some people to change. So what other benefits might you expect if you pay your truck driver a W-2 rather than a 1099?

We’ll talk about several topics in this article that you might not have considered, like driver retention. The attitude of a driver who requests to be 1099. No concern about IRS fines.

Driver Retention:

We have been handling payroll for more than ten years. We can say with certainty that W-2 drivers stay with a trucking company longer than 1099 drivers do. While there are numerous possible explanations for why this might be the case, a good number of them involve the trucking company. If you treat your drivers well, perhaps that’s not you. Providing good equipment, good routes with plenty of miles, and home time. There are businesses that don’t care. It makes sense that a business that doesn’t care about the driver’s needs or wants would also not care if they were paying the driver legally.

Let’s talk about the expense of driver turnover while we’re at it. A trucking company typically spends between $2,000 and $10,000 on each new driver. That’s a lot of money, especially if you know going in they are not a good fit for your business. That leads me to my next point.

Watch Out for Drivers Who Request 1099:

What if your driver requests or demands that you pay them via a 1099? Run away from that driver! Consider this. Why would a truck driver prefer a 1099 payment when they are entitled to a W2? More than likely they are attempting to get out of a legal need. It could be garnishment for a debt they were sued for, or it might be child support. Could be a tax levy or even refusal to pay taxes can cause problems. The driver is attempting to avoid paying what they should in each of these scenarios. They are stealing, to put it frankly.

It is theft if someone purchases an automobile, fails to make the installments, is sued, and continues to not make payments? Yes! They are stealing from all of us who do pay taxes if they refuse to do so.

So now that we’ve established they don’t mind stealing from people, tell us what prevents the truck driver from robbing you. It would be so easy to put 20 gallons of diesel into someone else’s truck on your fuel card while grabbing $51.40 from that driver? If they think the trucking company they work for owes them (Never happens, right?) they are past any other barrier stopping them. It’s not uncommon, and what if it happens to you?

No Concern for Being Caught Making Illegal Payments:

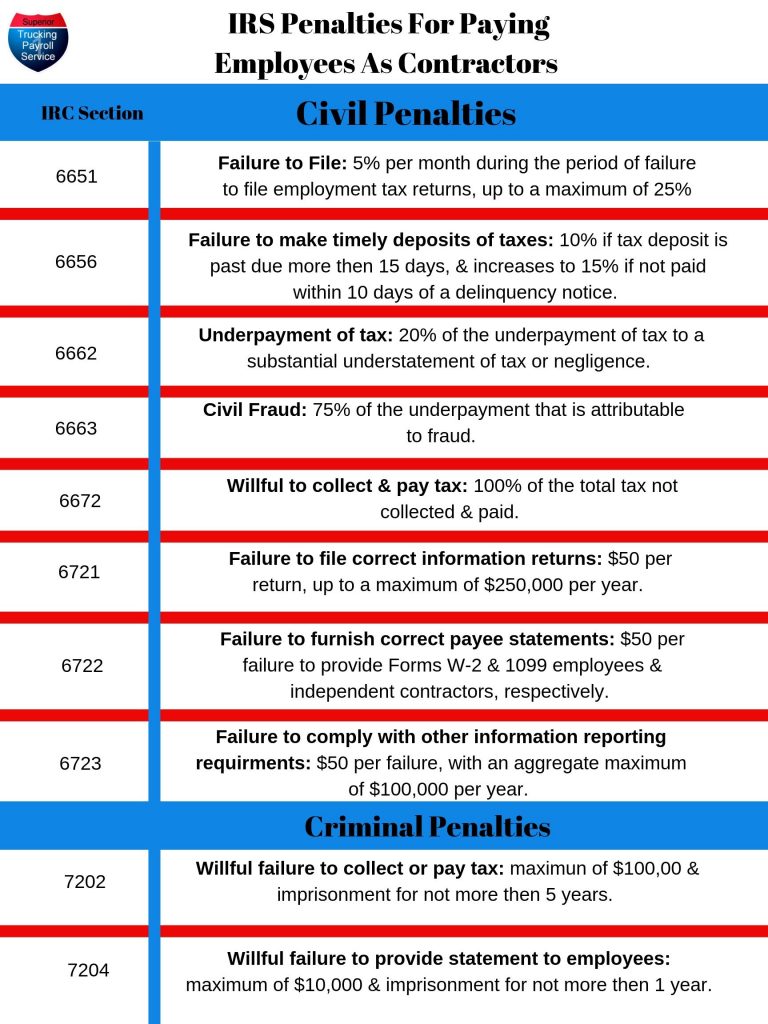

Don’t let your concern about being discovered keep you up at night. Stressing out over trying to save a few dollars is not worth it. In Michigan, there is a $1,000 per employee, per-day fine for failing to pay workers compensation when you were required to. Then there are all the IRS fees (do some quick calculation and let that figure sink in).

We may assist you in reducing the cost differences with the appropriate payroll methods. Request a free consultation with us and let’s talk about your situation. Our mission is to Help Trucking Companies, and we mean it!

Written by Mike Ritzema

Before founding Superior Trucking Payroll Service, Mike was the CFO of a trucking company with 80 trucks and a thriving brokerage. This experience gave him the perspective that a payroll solution has to make the lives of the office people better. All the solutions he has designed are to benefit everyone. Our company mission is to help trucking families and that includes the company owners, the drivers, and the office.