What is form 1099-MISC?

1099-MISC is a form you’ll use to report miscellaneous income and expenses to the IRS. 1099 MISC previously had been the form 1099 drivers would get come tax time. There have been some changes since 2020, and you’ll want to review them in order to avoid any mistakes that lead to penalties.

The biggest change to the 1099-MISC form is that payments over $600 that are made to nonemployees (such as independent contractors) are no longer reported in box 7 of the 1099-MISC. That information now gets filed on a 1099-NEC. (We will get into 1099-NEC soon.)

In this article, I will explain who needs to fill out this form and how to go about filling it out and submitting it.

Who needs a 1099-MISC?

If you are an independent truck driver you should receive a Form 1099-MISC which you will have to report on Schedule C along with other income. This form accounts for all self-employment income that you have received. You can use Schedule SE to calculate your self-employment tax and report the taxes on your Schedule C (Form 1040).

How to fill out a 1099-MISC:

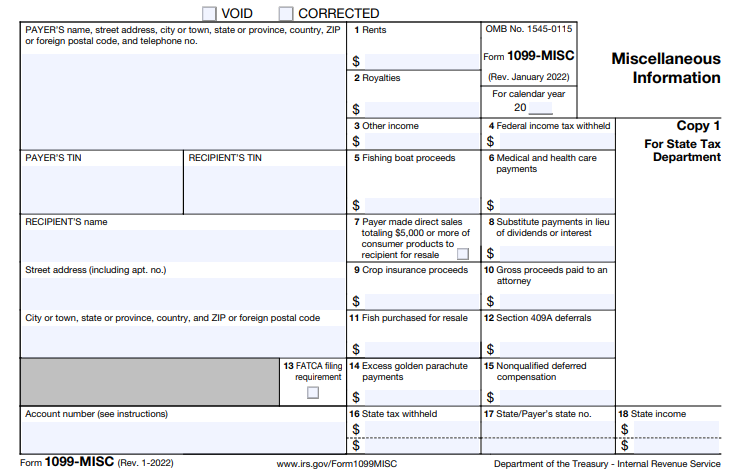

The first step is to enter in your address, phone number and your TIN. If you are a single member LLC or sole proprietorship, your social security number should be entered for the TIN.

Boxes 1-14: Excluding box 7 which doesn’t require a monetary amount, fill in the correct amounts for applicable sections.

1: Rents – if you pay rent for your office to a landlord, you’d file a 1099-MISC, but if you rent space from a corporation, real estate agent, or property manager, you won’t need to.

2: Royalties – intangible property, which include patents, copyrights, trade names, payments from oil, gas and mineral properties, and payments to authors or artists for use of their works.

3: Other income – any other payments made over $600 that don’t correspond to another box on the 1099-MISC as well as prizes or awards that are not for services performed.

4: Federal income tax withheld

5: Fishing boat proceeds – any amount paid out from a sale of a catch

6: Medical and health care payments – if you pay individuals for healthcare-related services, like drug screening, you would record those payments here. (This does not apply to payments made for healthcare premiums.

7: Payor – you just need to check the box if you made direct sales of $5,000 or more to a recipient for resale, and then provide a separate report of those direct sales transactions.

8: Substitute payments in lieu of interest – this typically applies when there is a loan of a customer’s securities and interest is accrued as a result.

9: Crop insurance proceeds

10: Gross proceeds paid to an attorney – there’s more fine print related to this one, so if you have any legal situations you’ll want to speak with your CPA.

11: Fish purchased for resale

12: Section 409A deferrals – first, check Notice 2008-115 because you may not have to fill out this section.

13: Excess golden parachute payments – compensation payments made to a disqualified person relating to a change in control of a corporation.

14: Nonqualified deferred compensation

When should I file the 1099-MISC?

You’ll need to send a copy to the person (or company) who you paid so that they can use it to file their taxes. The deadline for this is January 31st, or the following Monday if it falls on a weekend.

If you choose to file via paper you are required to fill out a Form 1096. If you file electronically, March 31st is your deadline.

Written By Mike Ritzema

With over 20 years of experience in entrepreneurship, management, business planning, financial analysis, software engineering, operations, and decision analysis, Mike has the breadth and depth of experience needed to quickly understand entrepreneurs’ businesses and craft the most suitable solutions.