What Records Should I Keep for my Trucking Company?

Trying to keep your business records organized can seem like a daunting task. But it’s very important to have a method to catalog and keep track of your records so that come tax season you can file your returns with ease. In this article, I will explain why you should keep good records, which ones you need to keep, and how long you need to keep them.

Every trucking company must keep records because they will help you monitor the progress and profit of your business as well as prepare financial statements. Good records will also help you identify your sources of receipts, keep track of deductible expenses, and prepare your tax returns.

Technically, the law does not require you to keep any specific records, so you should choose a recordkeeping system suited to your trucking company’s needs. Your recordkeeping system should include a summary of your business transactions. This summary is usually made in your books, which show your gross income, as well as your deductions and credits.

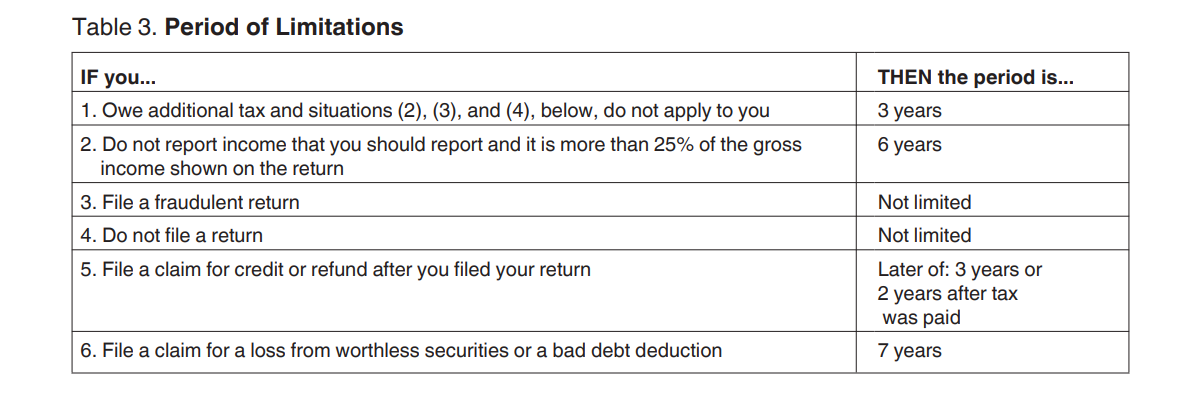

Gross receipts – the income you receive from your business. You should keep supporting documents that show the amounts and sources of your gross receipts. See the “period of limitations” table below for how long to keep these records. Some examples are cash register tapes, bank deposit slips, receipt books, invoices, credit card charge slips, 1099-MISC forms, and 1099-NEC forms.

Inventory – any item you buy and resell to customers. See the “period of limitations” table below for how long to keep these records.

Expenses – costs that occur to carry on your trucking company. You should keep documents that show the amount paid and that the amount was for a business expense. See the “period of limitations” table below for how long to keep these records. Examples of these are canceled checks, cash register tapes, account statements, credit card sales slips, invoices, and petty cash slips for small cash payments.

Travel, transportation, and gift expenses – have specific recordkeeping rules which are explained in this article, but generally, these records must be kept for 3 years.

Employment taxes – keep all records of employment taxes for at least 4 years.

Your records should include:

• Your EIN

• Amounts of tips reported to you by your employees

• The fair market value of in-kind wages paid

• Any employee copies of W-2 and W-2c forms returned to you as undeliverable

• Periods for which employees were paid while absent due to sickness or injury and the amount and weekly rate of payments you or third-party payers made to them

• Dates and amounts of tax deposits you made and acknowledgment numbers for deposits made by EFTPS

• Documentation to substantiate any credits claimed

• Amounts and dates of all wage, annuity, and pension payments

• Records of allocated tips

• Names, addresses, SSNs, and occupations of employees and recipients

• Dates of employment for each employee

• Copies of employees’ income tax withholding certificates (W-4, W-4P, W-4(SP), W-4S, and W-4V)

• Copies of returns filed and confirmation numbers

• Records of fringe benefits and expense reimbursements provided to your employees

Assets – machinery, trucks, and furniture you own and use in your company. You need to keep records to figure out the annual depreciation and the gain or loss when you sell the assets. Keep records relating to your assets until the period of limitations expires for the year in which you dispose of the property. Your records should show:

• When and how you acquired the asset

• Cost of any improvements

• Deductions that are taken for depreciation

• How you used the asset

• Selling price

• Purchase and sales invoices

• Purchase price

• Section 179 deduction taken

• Deductions that are taken for casualty losses

• When and how you disposed of the asset

• Expenses of the sale

• Real estate closing statements

Records for nontax purposes – do not discard them until you have checked to see if you have to keep them for other reasons. For example, your insurance company or creditors may require you to keep them longer than the IRS does.

If you need further assistance with your trucking company’s bookkeeping, you can explore more of the articles we have written, or call ATBS for all of your accounting, tax, and bookkeeping needs.