Different Ways to Pay Per Diem

There are a few different ways you can pay per diem to your drivers; per day, by the mile and as a percentage of truck driver pay. But it’s important to know the difference, and which is better for your trucking company, because if you choose to pay by the mile or as a percentage of truck driver pay you may be missing out on some savings.

One change when becoming a truck driver is that you’re often away from home, and need to buy all of your meals or snacks on the road. In order to help, many trucking companies provide daily per diem pay as an alternative way of compensating you for your daily expenses such as meals or lodging. The term per diem translates to ‘by day’ in Latin, so the most common and easiest way to pay per diem is to pay $69 (maximum) per night away from your home.

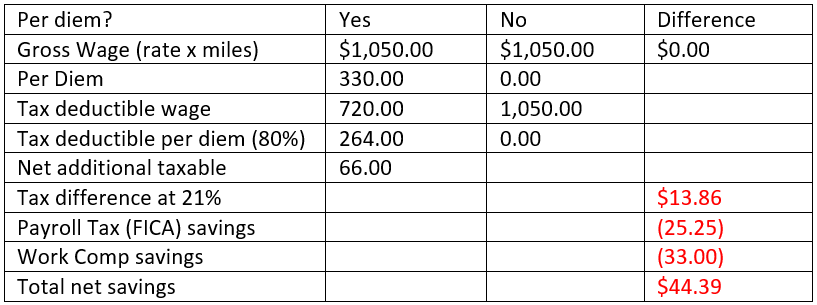

Another way to pay per diem is by the mile. Let’s say you have a driver making 42 cents per mile and for a week they drive 2500 miles in five days. They would have made $1050.00, $330.00 of which would be classified as per diem. For a trucking company in Michigan that would mean you would save $44.39 in taxes for that one employee, in one week. As the employer, you’ll save over $2300.00 per driver per year in worker’s compensation insurance premium and payroll taxes, shown in the table below. Your company will also benefit from improved driver retention as the take-home pay for them just went up almost $4,400.00 per year.

Your company can also choose to pay per diem as a percentage of truck driver pay. For this example, if you make $1,180 in load pay, your employer can set a per diem rate of 15%, so that $180 can go untaxed. The advantages to this way of paying per diem is that you’re always guaranteed X%, no matter how many miles you drive, or days you work. But per diem as a percentage depends on the company you work for, and can vary from trucking company to trucking company.

However, if you choose to pay by the mile or as a percentage of truck driver pay you may be out of compliance with the IRS rules on per diem, so make sure to read them thoroughly.

On page 14 of IRS Revenue Procedure 19-48, the IRS specifically allows per mile per diem pay as long as it does not exceed the $66 per day limit. The example below is from Revenue Procedure 19-48:

“Example 2. Taxpayer, a truck driver employee in the transportation industry, is paid a “cents-per-mile” allowance that qualifies as an allowance paid under a flat rate or stated schedule as defined in section 3.03 of this revenue procedure. Taxpayer travels away from home on business for 10 days. Based on the number of miles Taxpayer is expected to drive per day, Taxpayer’s employer pays an allowance of $600 for the 10 days of business travel. The CONUS special M&IE rate is $69 per day. Taxpayer actually drives for 8 days, and does not drive for the other 2 days Taxpayer is away from home. Taxpayer is paid under the periodic rule used for transportation industry employers and employees in accordance with section 4.04(4) of this revenue procedure. The amount deemed substantiated is the full $600 because that amount does not exceed $690 (10 days away from home at $69 per day).”

This example follows the IRS regulations for per diem, however, the $90 surplus can cause an added expense for the company. The result is that the driver pays more in taxes and your trucking company pays more in worker’s compensation insurance than what was necessary.

Read more about how to save money by paying per diem →

This article explains all the ways you can save money, as well as gives you a simple per diem savings calculator.

Written by Gentry DeWinter

Gentry graduated from Grand Valley with a Bachelor’s Degree in multi-media journalism. She is an artist who loves videography, writing, and hopes to one day own multiple dogs.