Ways We Look Out for Your Business From operating accounts...

Read MoreAnother way to ask this is “How do I know that my taxes were paid?” We’ve all seen the headlines of a payroll company running off with their clients’ tax money. It is a scourge on the payroll profession that a few people with no morals make us have to wonder about everyone. Fraud is not unique to payroll but it does happen with bad payroll companies.

This is a problem as well because if the IRS feels bad for you and the taxes that you paid to the payroll service, they will still do what they can do to collect from the employer.

So, how can you know your payroll taxes are paid on time?

The first thing is to make sure you are able to log in to eftps.gov. You should be able to see all the payments to the IRS made on your behalf there. There may be a delay of a day or so but you won’t be six months behind. If you do not have your username or password, there are reset password options available there.

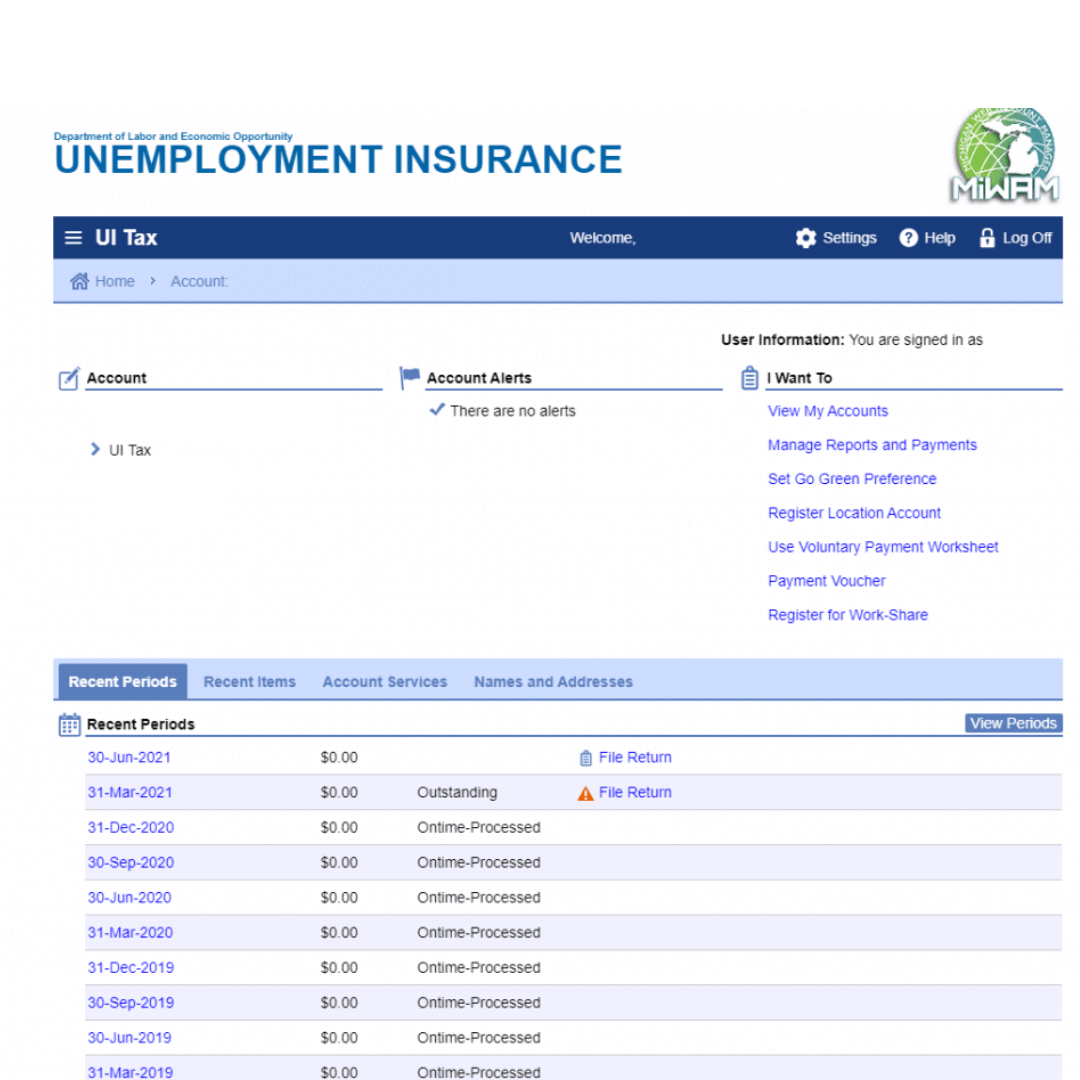

We also suggest doing the same for your state and local withholding and unemployment accounts as well. You never want to be caught off guard by a payroll tax letter, especially one that was because your payroll service didn’t pay in as they were supposed to do. Monitoring the account may fix issues before the letters get sent too. Below is an example from Michigan Unemployment.

Written by Mike Ritzema

With over 20 years of experience in entrepreneurship, management, business planning, financial analysis, software engineering, operations, and decision analysis, Mike has the breadth and depth of experience needed to quickly understand entrepreneurs’ businesses and craft the most suitable solutions.

Contact Us!

Driver Retention Tips

One of the biggest problems for businesses in the world...

Read MoreHow to Avoid Payroll Errors and Penalties in the Trucking Industry

Are you tired of dealing with payroll issues in the...

Read MoreWhy Was No Income Tax Taken Out of my Paycheck?

Why Was No Income Tax Taken Out of my Paycheck?...

Read MoreUnderstanding Supplemental Payroll Fees: What They Are and Why They Matter

Are you a business owner trying to understand the complexities...

Read More