How Much Will My Payroll Cost?

Let's Talk Pricing!

At Superior Trucking Payroll Service, honesty and clarity are our top priorities. Our goal is to ensure our clients have trust in our payroll services by offering clear and concise answers to all of their questions. Some questions, such “How much does payroll cost?” aren’t simple to answer, though. Payroll services are intricate, with various factors influencing the pricing. By providing information about payroll pricing and helping you make educated decisions and maybe save money before using our services, we hope to simplify the process.

Payroll Services Include:

- Up to 5 direct deposit accounts per employee

- Garnishment calculation and remittance

- Tax calculation, remittance, and reporting

- 941’s, 940’s, state withholding, local withholding, unemployment

- W-2’s, 1099’s (to the employee & required government agencies)

- Paystubs emailed to your employees BEFORE payday

- Paystubs online 24-7 at www.truckingpaychecks.com

- Pay as you go workers compensation insurance (varies by state)

- Full and customizable reports

- On-demand wages through ZayZoon

- Companies with 2 or more W2 employees get a free labor law poster.

- AscendTMS integration

Additional Fees

State Tax Set-Up:

- If you set up state taxes when you sign up for our payroll services no fee's will accrue

- If you add an additional state, the fee is $50 per state

- If you need to discontinue a state, the fee is $100 per state

When this happens with our clients, we charge a $15 per week fee as a “missed payroll fee”. We use these funds to offset our time to keep your tax filings current. This allows us not to bill you for a quarter-end fee or tax filing fee like other payroll services do.

Our job is to make your lives easier not add frustrations. We offer dedicated and personal service, meaning you will always be able to talk to someone who will know what is going on with your account. We have no set call times and have no rules about when or how you submit data. We accept emails, faxes, and phone calls, and offer an online portal where you can submit your data.

We strive to make your payroll process run as smoothly as possible so that you can get on with the rest of your work.

When you have locations in multiple countries all paying under one Federal ID Number.

If you’re aware of payroll laws that you might encounter and price is the only thing that matters.

If you need to pick up paper checks, or other documents, because email won’t work for your company.

FAQs

Not only do we form relationships with our customers but we make sure that we fit our payroll service to their specific needs. We can customize what’s on your paystub such as; load number, delivery date, the city the driver started in or ended in, or both, or miles driven.

we charge a $15 per week fee as a “missed payroll fee”. We use these funds to offset our time to keep your tax filings current. This allows us not to bill you for a quarter-end fee or tax filing fee like other payroll services do.

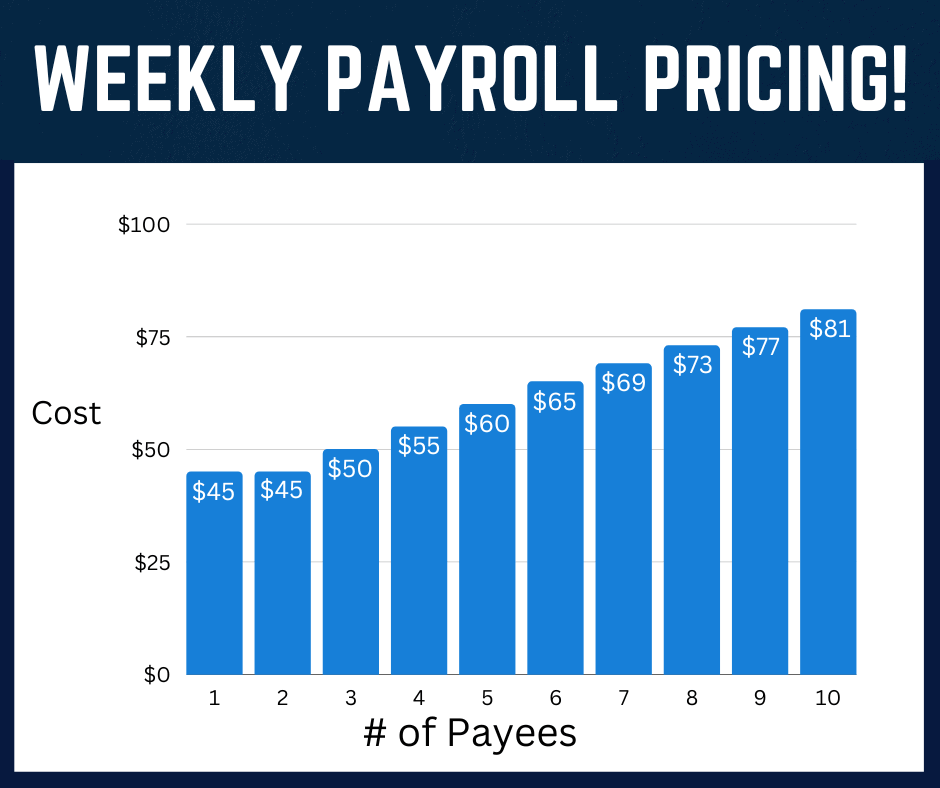

We believe that people like simplicity, especially when it comes to pricing. Our base fee starts at $45 a week for up to two payees. It doesn’t matter if they are 1099, W2, or a combination. Still $45 a week. Any additional payee over that two is an extra $5 per week, making paying three payees $50 a week. If you’re a larger company then your price per employee could be a little bit lower.

You can cancel our services at any time. We do need a phone call or email from the owner, or from our main contact for the payroll, with the date of the last payroll that they will be doing with us. We don’t have a cancelation fee.

First, we will try to contact you. We do this so you know we received your email and so you can select a time for a brief conversation. But why do we need to talk? Because we want to make sure that you get the solution you want, even if it is not us.

It’s not too difficult to switch to us. We do most of the work for you. For a 10 – 15 Payee payroll, once you get us your information, we only need about 2 weeks to get you up and running.

Federal Employer Identification Number

Bank information

Basic company information

- Basic payee information

Contact Us!

Have questions about our payroll services? We’re here to help! At Superior Trucking Payroll Service, we prioritize honesty and clarity, striving to provide clear and concise answers to all your inquiries. Whether you’re curious about pricing, service details, or the transition process, our team is ready to assist you every step of the way. Don’t hesitate to reach out – we’re committed to simplifying your payroll experience and ensuring you have the information you need to make informed decisions. Contact us today to get started!